The first half of 2022 has been a rocky one for many parts of the Sydney property market. The exuberance of 2021 feels like a distant memory for vendors who are now faced with a property market impacted by increasing interest rates and declining market confidence. The change in market conditions has been quite rapid, and caught many off guard. However, it’s not all doom and gloom, and it’s worth keeping things in perspective. Interest rates, whilst increasing, are still very low from an historical perspective. Unemployment is at record lows, and household balance sheets are quite healthy. Prices are softening in Sydney, and a two tier market is emerging.

According to Corelogic, the overall Sydney market declined 1.6% in June 2022, and is 3.1% lower than the peak (January 2022).

Source: Corelogic

These headline figures are interesting, but they’re also not necessarily representative of what’s happening in every part of Sydney. On the ground, I’m seeing things a little differently. I keep in the touch with the wider Sydney property market, and am always speaking to agents from across the city, however my focus area is the Inner West. Across Sydney’s Inner West, in general prices have fallen by far more than 3.1% since January. Anecdotally, I’ve seen many examples of properties selling for between 10%-20% lower than what they might have achieved in late 2021/early 2022. However, I’ve also seen a few examples of some properties achieving prices that are reminiscent of the heady days of 2021. There is a very clear divide in the market, which is getting more pronounced as the year progresses. Nervous buyers are sitting on the sidelines, and are giving a wide berth to anything that might be deemed a secondary property. This includes properties on main roads, properties with awkward floor plans, and generally any sort of property that might be seen as risky. Cookie cutter units in newer developments are generally seeing similar results. However, a-grade properties are still attracting crowds.

Essentially, there are two separate markets running at the moment, based along quality lines. Whereas last year, many buyers were happy to purchase properties that might have had a couple of issues, at the moment, those properties aren’t selling well. Take for example a property on a relatively busy road. In 2021 I used to see multiple bidders competing for these type of properties, buoyed by the fact that they might be able to purchase a property in a suburb that they might otherwise be priced out of. In a similar way, properties that needed major renovations were often fetching eye watering prices. The price gap between these ‘fixer uppers’ and renovated properties was often nowhere near enough for a renovation project to stack up. These days, the market has flipped completely. The sharp increase in building costs has meant that properties that require major renovations are no longer the hot property that they were last year.

So, there’s a clear demarcation between how different types of properties are performing at the moment, but there’s also an emerging trend based on price point. As has been common in other downturns, the affordable end of the property market is holding up better than the prestige end.

“The greatest falls over the June quarter were at the top end of the market, with the upper quartile down 4.3 per cent, while values for the bottom quartile fell only 0.5 per cent.”

Source: www.smh.com.au

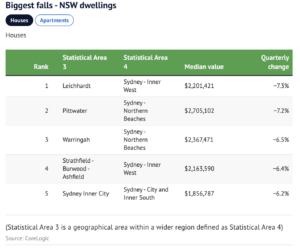

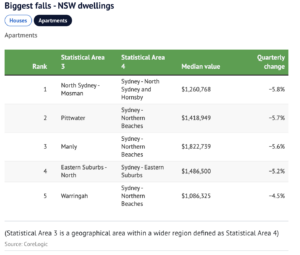

The below two graphs, from Domain, show the quarterly change in house and apartment median values for the June quarter, for some areas in Sydney. The biggest falls were noted in some of the more expensive areas, across both houses and units.

It’s important to note that this is just representative of a point in time. Whilst the more affluent suburbs have recorded the highest declines so far, this doesn’t mean that more affordable areas will be immune, as the ripple effect gains steam. In fact, as interest rates continue to rise, there are concerns around some pockets of Sydney’s ‘commuter belt’, in particular in parts of Sydney’s west.

New stock listings are down, keeping a lid on price falls in some segments of the Sydney property market

Faced with falling auction clearance rates, and a softening market, would be vendors need to weigh up whether now is the best time for them to sell. Ultimately, that depends on a number of things, including the personal situation of the vendor and their expectations as to future market movements. It seems quite a few have taken the view that they may be better served to sit it out, and wait for things to improve. The below graph from SQM research, shows new listings declining in recent months for Sydney.

This fall in new listings is limiting the amount of options available for home buyers. In turn, it’s also partly limiting the current price declines, as there currently isn’t a rush of vendors looking to add new supply to the market. Obviously, this is a Sydney wide perspective, and doesn’t hold everywhere. Some areas are impacted by substantial amounts of new supply, and in these areas there are rightly more concerns about larger price falls in the coming months.

However, at the same time that new properties coming onto the market are slowing, overall supply is up on the previous year, indicating that some properties are struggling to sell. There’s also early indications of some increase in mortgage stress in some areas, although this isn’t seen as widespread and reported numbers are relatively low at the moment.

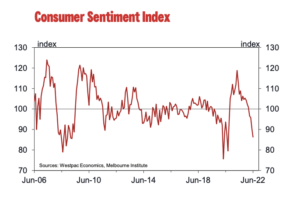

Consumer sentiment is taking a hit, but there are reasons to be optimistic

In recent months, consumer sentiment has fallen dramatically. That’s not really surprising, given the challenging situations facing many. War in Ukraine has been top of mind since February, petrol prices have spiked, as have the prices of everyday goods. The combined impact of this, along with sharemarket and property market declines, has had a clear impact on overall consumer sentiment. This is shown clearly in the below Consumer Sentiment Index, produced by Westpac.

Source: Westpac

A lot of media focus has been on the Sydney property market, in particular regarding the potential impacts of increasing mortgage rates and what that may mean for property prices. It’s worth noting two very important points in this regard. Firstly, Australian banks are required to include substantial buffers when analysing a potential borrower’s capacity to repay debt. These act to help ensure most borrowers are still fine, even with forecast interest rate increases. Secondly, the average Australian household has quite a strong balance sheet. As noted in my May 2022 update, the RBA has noted that “the median excess payment buffer for owner-occupiers with a variable-rate loan was equivalent to around 21 months’ worth of scheduled payments in February 2022, up from around 10 months’ worth at the start of the pandemic”.

The below graph shows the trend in Australian household balance sheets, measured by total assets against total liabilities. Even though this data doesn’t include 2022 numbers, it provides some evidence that things may not be as bad as many believe.

Source: RBA

“The incidence of household financial stress is low and declining, but a small share of households are vulnerable to cash flow shocks …”

Source: RBA

Inflation concerns continue, but there’s light at the end of the tunnel

One of the major issues facing the economy, and therefore one of the main headwinds for the Australian property market, is the ongoing concern around inflation.

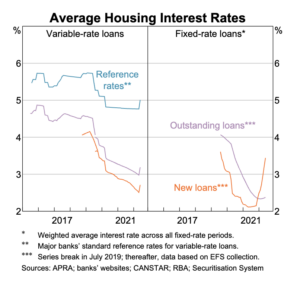

The RBA’s attempts to get inflation back under control are evident in the below graph, which shows the recent spike in home loan rates. The increase in fixed rate loans has been sharp. In fact, CBA recently increased their fixed rate mortgages by 1.4% in a single move. This talks to their expectations of future rate movements, but also reflects the funding pressures that banks themselves are under.

Source: RBA

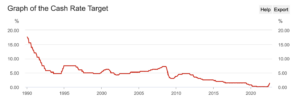

Notwithstanding these increases, it’s important to keep things in perspective. The below graph shows the RBA cash rate from January 1990 to today. Even though the cash rate has increased recently from 0.10% in April 2022 to 1.35% in July 2022, from an historical perspective rates are still very low.

Source: RBA

Interestingly, in recent weeks, a few market commentators have started to point to inflation being brought back under control a little earlier than previously thought, with the implication that there might actually be cause for interest rate falls at some stage in 2023, following further rate rises throughout the remainder of 2022.

Source: ASX

Investors are eyeing up opportunities

According to the AFR, Sydney combined rents have increased by 17.5% over the past 12 months. The below two charts, from SQM Research, show the steep drop in vacancy rates for Sydney property, alongside increasing rents.

Source: SQM Research

From a Sydney property investor’s point of view, the higher weekly rents need to be weighed up against increased holding costs (mainly driven by higher interest rate payments). Anecdotally, I’ve recently noticed an increase in enquiry from people interested in investing in the Sydney property market, buoyed by less competition for good assets, and expected future revenue via rental increases.

There are opportunities in the Sydney property market… if you’re willing to focus on the long term and avoid the noise

There’s so much to consider when analysing the Sydney property market, and the data I’ve provided here is just scratching the surface. Sydney is a big place, made up of lots of different property markets. At any given time, some will performing well, some won’t be. The important thing is to understand what’s happening at the local level, wherever that is for you.

One thing that’s missed in a lot of the media soundbites is that the economy is fundamentally fairly strong. Wages are increasing (though many are still seeing net wage declines, after taking into account inflation), unemployment is very low, and immigration is ramping back up. Inflation is definitely a concern, however as noted above, there seems to be a path where inflation peaks later this year/early next year, and leads to potential interest rate decreases from late 2023. Whilst inflation is certainly impacting market sentiment, it’s worth noting that this can actually positively impact property – renovated established dwellings are seen as more attractive, given increases in building costs, and that helps provide a floor price.

Despite the current market turbulence, there are some great buying opportunities around. Lower levels of competition (including some first home buyers who are waiting for the recent NSW government stamp duty changes to take effect) and more realistic price expectations on the part of vendors means that buyers are currently in the driving seat. How much longer that remains the case isn’t certain, but for those that are sitting on the fence, this market is one of the best I’ve seen in recent times for buyers, and there are definitely opportunities around. Feel free to get in touch if you’d like to discuss anything.

See you next month.

Brendan

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.