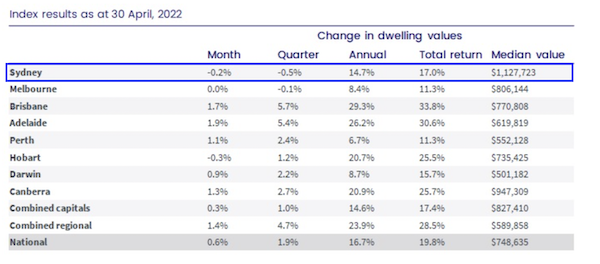

Corelogic recently released their monthly dwelling price index for April 2022, which showed a slight decrease in dwelling values for Sydney for the month, with house prices declining 0.1% and units 0.4%.

Source: Corelogic

Source: Corelogic

2021 was a sellers market, with an under supplied market encouraging buyer FOMO. This seems to have now shifted back toward a more normal market. Corelogic notes that, in Sydney and Melbourne, ‘advertised supply levels have normalised‘.

‘‘ Demand has been falling in these markets (Sydney and Melbourne) as shown by the slower absorption rate, which has allowed supply levels to bounce back to long-term average levels in Sydney and above average levels in Melbourne”

Tim Lawless, Corelogic

(Source: AFR)

I’ve certainly noticed a distinct reduction in urgency amongst many buyers, and the FOMO of 2021 has been replaced by a more cautious buyer pool. Many auctions I’m attending are attracting a few bidders, but not the quantity that I saw last year. Further, the buyer interest isn’t nearly as aggressive. I’ve also been tracking lower auction clearance rates, suggesting that there is currently a disconnect between what vendors are hoping for and what buyers are prepared to pay.

Below are some of the main factors I see impacting the Sydney property market at the moment.

The Inflation genie

The last couple of weeks have seen quite a dramatic shift in media attention, with inflation one of the key talking points. A quick check of Google Trends (which gives insights into web search traffic for a certain keyword), suggests searches for the word ‘inflation’ in Australia have increased roughly four-fold in recent weeks.

Source: Google Trends (accessed 3 May 2022)

The sharp spike in inflation, which surprised the market somewhat last week, has helped focus a lot of media attention on related topics such as the cost of living and expected interest rates rises. Rising inflation has forced the hand of the RBA, which lifted the cash rate by 0.25% on May 3rd, the first increase since November 2010.

As it relates to the Sydney property market, the impact is twofold. Firstly, most home buyers rely on some sort of mortgage to help them finance the purchase of their property. Any increase in interest rates increases the debt repayments, but also acts to reduce the amount that borrowers can borrow. This in turn limits the amount that people are willing and able to offer for a particular property. Secondly, and perhaps more importantly at the moment, it impacts market sentiment.

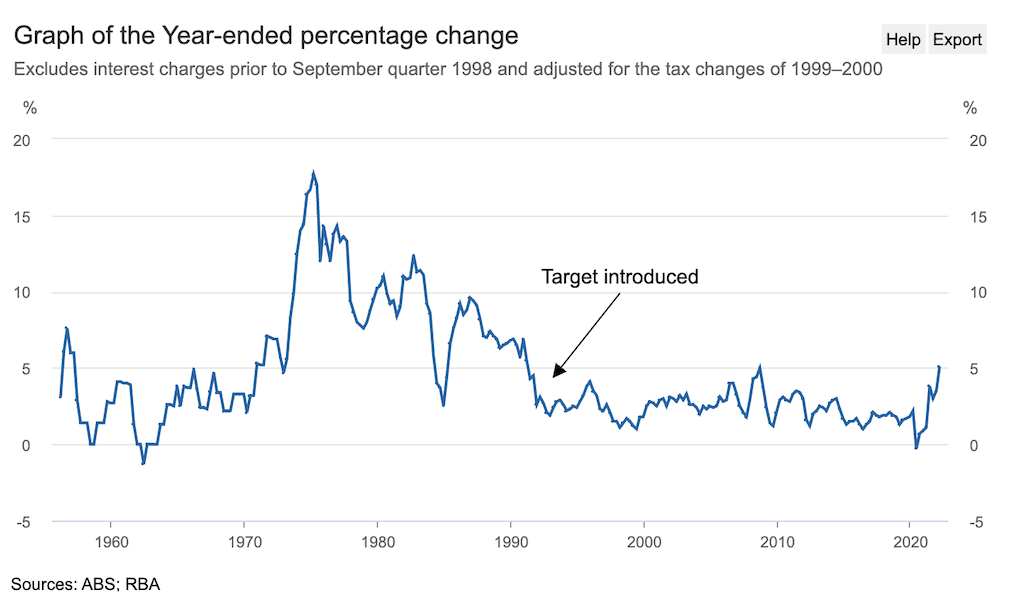

To understand a little more about the inflation situation, I think it’s important to look at things from a historical perspective. The below graph from the Reserve Bank of Australia shows the Consumer Price Index (CPI) from March 1956 to now. This shows that there has been a definite spike in recent months, and also shows the current inflation rate is above the RBA’s stated aim “to achieve an inflation rate of 2–3 per cent, on average, over time.”

Source: RBA

Source: RBA

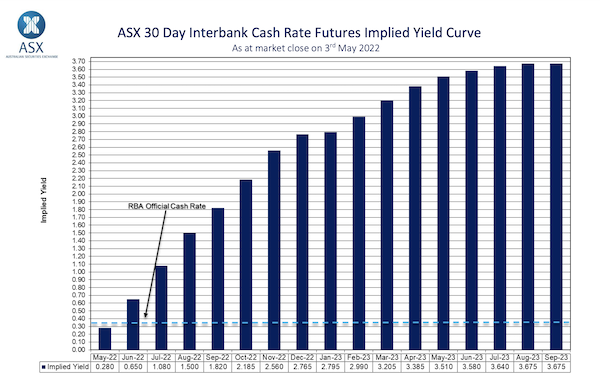

There’s already been a lot of media attention around the impact of higher interest rates, and some property commentators are calling this out as being hyped up. There’s no doubt in my mind that the media love a good fear story (it sells papers and gets views), but I’m also conscious that yesterday’s rate rise will be the first of many, something that seems to have been overlooked by some. A quick glance at the ASX 30 day interbank cash rate futures implied yield curve suggests the market is pricing in further increases.

Source: ASX

Source: ASX

Interest rates are increasing, but the impacts won’t be evenly spread

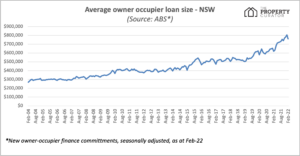

One thing to consider is that because interest rates are coming off historical lows, even relatively small interest rate increases can have quite a noticeable impact on a borrowers repayments. A 0.25% increase in the current environment will have a much higher percentage impact than a 0.25% rate rise when residential borrowing rates were 6% and above. Another thing to note is that the average loan size has also increased, as can be seen below, meaning interest rate increases are applied to a higher (average) loan balance.

Source: ABS

Source: ABS

The above chart shows how the average loan size for owner occupier new loan commitments (NSW only) has increased over time. It’s worth noting, however, that many existing borrowers have taken advantage of low interest rates to actively pay down their mortgages, with NAB noting that “70 per cent of our customers are well in advance of their payments”. Separately, in the Financial Stability Review of April 2022, the RBA noted that:

“the median excess payment buffer for owner-occupiers with a variable-rate loan was equivalent to around 21 months’ worth of scheduled payments in February 2022, up from around 10 months’ worth at the start of the pandemic”.

So, even though average loans for new borrowers have increased, potential mortgage stress is somewhat reduced due to the fact that many borrowers have built up buffers. In fact, it’s estimated that around ~28% of home owners in Sydney own their property outright. This percentage varies widely across Sydney however. Many areas, such as those on the fringe of the city, have large concentrations of first home buyers who haven’t built up significant equity buffers, nor do they necessarily have the cash-flow in place to withstand significantly higher interest rates. Notwithstanding the fact that banks and other mortgage providers need to stress test the ability of borrowers to withstand higher interest rate rises, sustained interest rate increases are likely to become an issue in some parts of the city, as noted in this article.

Interest rates are only one part of the puzzle

It’s easy to point to increasing interest rates as a potential reason for prices to crash, and many have made this argument. However, I feel this is too simplistic an approach. As I outlined above, interest rates will have an impact, and that impact is likely to be different in different parts of the city. However, it’s not all doom and gloom. Below are a few things to consider, that provide counter arguments to the idea that increasing interest rates will result in Sydney real estate prices crashing:

- International migration is tipped to return to pre-covid levels during 2022, adding demand for property (skewed to rentals initially)

- Recent analysis points to concerns around a housing undersupply developing in Sydney

- Price levels are also partly insulated, due to the fact that the cost of building new property has increased substantially in recent times. According to the ABS Producer price index, input prices to house construction rose 15.4% over the 12 months to April 2022

- Rents are on the rise, at the fastest rate in 13 years, and vacancy rates are declining rapidly. This has led to increased interest from some investors, however, as I noted in my March 2022 newsletter, this is creating a significant issue for tenants across the city and there doesn’t appear to be any significant policies on the horizon to deal with this problem

Wrapping up

In summary, the Sydney market has cooled, and it’s clear the upward pricing pressure from 2021 has disappeared. In my experience, I’m still seeing good properties sell for fair prices. However, anything that’s deemed a secondary property (eg concerns around easements, poor layout, located on main roads etc) are struggling, and vendors/agents are often being forced into price reductions to attract buyer interest. I’m also seeing far fewer instances of properties selling for substantially more than the price guide.

‘‘ Growing evidence confirms Sydney’s steepest upswing on record has ended and swinging power back towards buyers. This has created better purchasing conditions providing buyers time to contemplate rather than compromise, and ultimately allowing rational decisions to be made.”

(Source: Domain)

I’m currently finding great deals for clients, with competition from other buyers significantly reduced. I deal mostly with owner occupiers but also some investors. Both sets of clients have long-term buy and hold mindsets. As long as they’ve accounted for higher interest rates, they’re still comfortable in moving forward. There are opportunities now that I haven’t seen for quite a while.

‘‘ With higher inventory levels and less competition, buyers are gradually moving back into the driver’s seat. That means more time to deliberate on their purchase decisions and negotiate on price”

Tim Lawless, Corelogic

(Source: Corelogic)

Will 2022 see price declines? In some of the suburbs I’m most active in, I’ve already seen it, with some properties selling for around ~5% below what comparable properties sold for in late 2021/early 2022. Anecdotally, I’ve heard of other areas where +10% corrections have already been felt, particularly for higher end properties. The heady days of 2021 are definitely behind us, but I don’t expect to see major across the board price declines for Sydney for 2022, for the reasons outlined above. As always, some areas will outperform and some will see sharper price declines. The key is knowing which properties are which…!

See you next month.

Brendan

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.

This article was first published on LinkedIn