Update: Following the NSW election on 25 March 2023, there was a change in government. As a result, the property tax mentioned in this article is scheduled to be scrapped on 30 June 2023 according to the SMH. From 1 July 2023, first homebuyers will no longer be able to access this policy, with a revised first home buyer policy replacing it.

The NSW treasurer, Matt Kean, recently handed down his first budget. One of the cornerstone policies of this budget is a major change to the way stamp duty is collected and managed in New South Wales, under an initiative called “First Home Buyer Choice“.

What are the proposed changes to the New South Wales stamp duty laws?

In short, the NSW government is looking to ease the upfront burden for first home buyers in the state, and has adopted a policy that would see first home buyers given the choice of paying an upfront amount, as is currently the case, or to instead pay a yearly fee based on the unimproved value of the land for that property (much like how land tax is levied). The policy would only apply to eligible first home buyers, for properties up to $1.5 million in value.

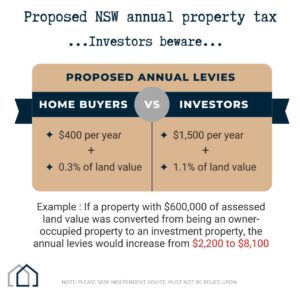

The proposed annual levy is $400 + 0.3% of the unimproved land value. NSW land values are re-assessed yearly, in accordance with the Valuation of Land Act 1916. Therefore, assuming the 0.3% annual levy is unchanged, the amount you would be expected to pay each year can still increase, if the land value increases. This is something that I expect a number of people will skip over, and will likely get a bit of a shock when the annual levy update comes in. For buyers that later elect to turn their property into an investment, the rate adjusts to $1,500 + 1.1% of the unimproved land value. This is a major consideration for buyers who think they may initially live in the property, but then turn it into an investment.

Frequently asked questions

How much will I save on stamp duty?

The proposed policy is looking to reduce the upfront amount that first home buyers need to pay to purchase a property. It’s not necessarily a policy that will see all home buyers save money over the long run. Whether you will save money under this proposal will depend on a number of factors, including how long you hold the property, the assessed land value of the property, and whether you’re looking to convert the property to an investment in the future.

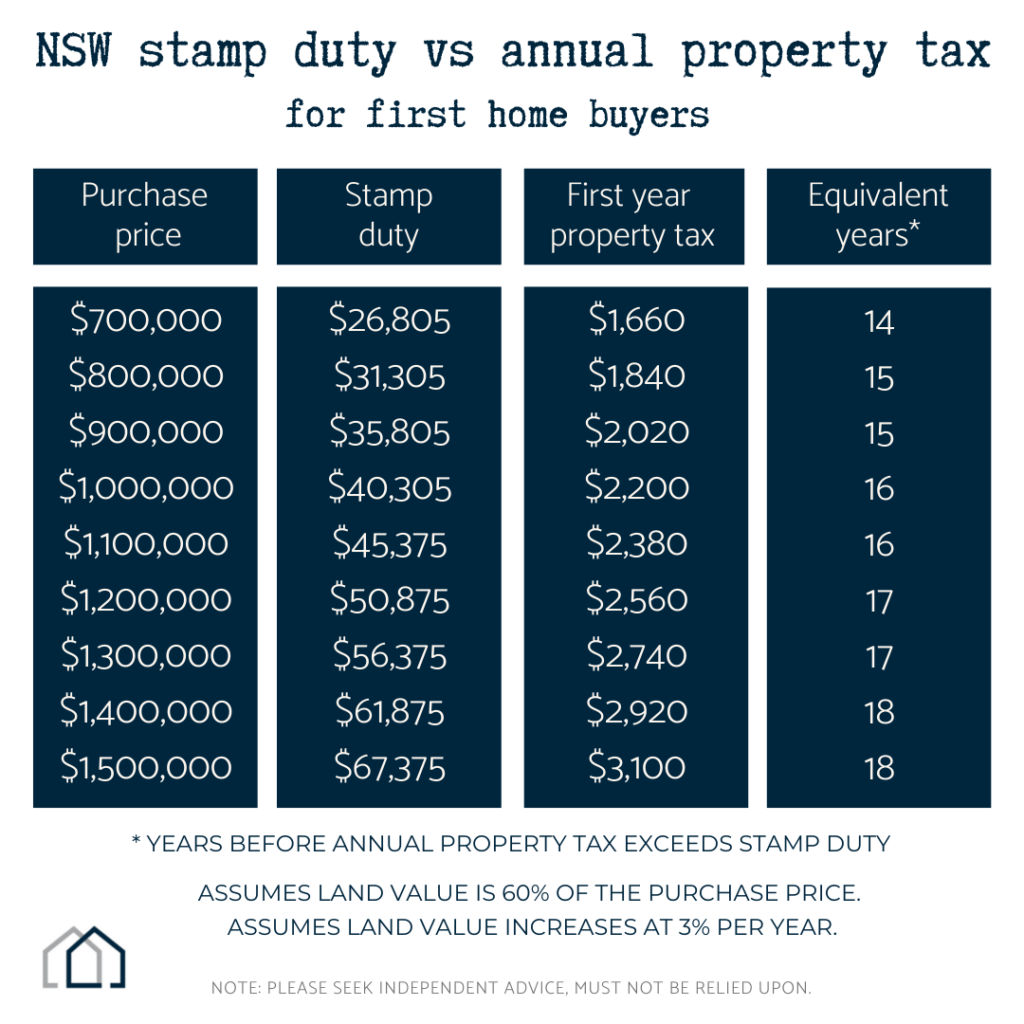

The below table gives an example of a number of different price points for properties with a 60% land to asset ratio, with assumed land value increases of 3% per year. It also assumes no other government incentives are available to the purchaser. In this case you can see the purchaser would be better off paying the annual fee, if they think they’re going to hold it for less than 14 years (increasing to 18 for the more expensive properties).

Should I pay my stamp duty upfront or pay it yearly?

Ultimately, that’s up to your individual circumstances. For first home buyers who are looking to get a foot on the property ladder, and are likely to upsize in the future, then it likely makes sense to look to an annual payment. The rationale here is that you’re not likely to be living in the property long enough to make the stamp duty option beneficial. However, for those who are worried about yearly indexation, or are looking to hold the property over the long term, it might make sense to focus on the upfront fee, and not be subject to yearly levies. It further muddies the water for first home buyers who are looking to convert their home into an investment property in the future. Regardless, this is a very big (and irreversible) decision. I’d recommend really taking the time to think through things, and don’t rush into a decision. And always make sure you seek advice from your accountant and other advisors.

I’ve heard that units might become more popular now, why is that?

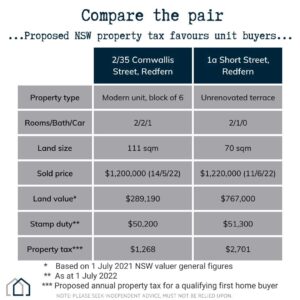

Under the current stamp duty regime, stamp duty is levied on the purchase price of a property. That is, a $600,000 house would pay the same amount of stamp duty as a $600,000 unit. However, under the proposed changes, the annual property tax would be levied on the unimproved land value of the property. Generally speaking, units have a much lower assessed land value, and as such would have a lower yearly property tax as a result.

The below graphic shows this impact, using two recent sales for Redfern, in inner city Sydney.

In this example, the yearly property tax for the unit would be less than half of that of the house.

How can I find out the land value of a property I’m looking to buy?

The easiest way is via the NSW valuer general, found here.

How do I calculate stamp duty in NSW?

The easiest way is via the NSW government online calculator, found here.

When does the policy come into effect

The NSW government has said the changes will come into effect on January 16, 2023, with them looking to legislate this policy in the second half of 2022. The government notes “For contracts signed in the period between enactment of the legislation and 15 January 2023, eligible first home buyers will be able to apply to choose the property tax, but they will still need to pay stamp duty and then apply for a refund of stamp duty from 16 January 2023”.

Will this policy be rolled out to other NSW property buyers?

No, not currently. It’s widely expected that the premier, Dominic Perrottet, will look to gradually phase out upfront stamp duty across the state. However, politically this isn’t straight forward, and there would be significant costs to the NSW budget in the short to medium term. As a result, the NSW treasurer, Matt Kean, has apparently made approaches to the new Federal government to see if federal support may be made available to assist in this transition. Given the numerous budget challenges facing the new Albanese government, this likely isn’t a high priority. So, currently the state government is “testing the waters” on this much awaited tax reform. Currently it only applies to first home buyers purchasing a property up to the value of $1.5 million. In the future this may be expanded, but there’s no timeframe for this, and with a state government election due within 12 months, there’s no guarantee this policy will be expanded anytime soon.

What happens if I decide to rent out my property, and I pay the annual land tax?

Even though the current proposal isn’t targeted at property investors, the NSW government has acknowledged that a segment of first home buyers that qualify for this policy will likely look to convert their property to an investment property in the future. The fine print of the announced policy allows for this, however adopts a much stricter tax arrangement, presumably to discourage this sort of endeavour. Rather than needing to pay an annual tax of $400 + 0.3% of land value, anyone who converted their property into a rental property would instead face an increased fee of $1,500 + 1.1% of land value.

The below graphic illustrates how this would play out, for a property that had an assessed land value of $600,000.

In this case, the annual property tax would increase from $2,200 to $8,100. This is quite a significant cost for investors, and in many cases it would be difficult to justify holding onto that property as an investment. Obviously, someone who was looking to convert an owner-occupied property into an investment property in the future would be well advised to consider this upfront, and work out if paying the stamp duty option would put them in a better overall position for the long-term.

How is this expected to impact the Sydney property market?

This policy has the potential to contribute to quite a fundamental change to the Sydney property market landscape. In the short term, I expect that would be first home buyers will hit pause, and wait until the changes have been legislated. That’s particularly the case for those who are looking at units, which have a longer break even period. For these buyers, it just may not make sense for them to choose the upfront stamp duty, when the yearly option appears substantially better for them (assuming they had no long term plans to convert a property to a rental).

In the medium to longer term, we may see a shift toward units and apartments gaining traction, within certain segments of the market, as first home buyers look to these property types as a way to reduce the annual property tax. The annual property tax is only one of many influences on the property market, but I expect a few people will be drawn in by those savings.

Is there a buying window now available?

I believe there is. As I noted above, I feel that quite a few potential buyers will wait until the policy is passed, before they enter the market. For those who are prepared to take a long term view, the next little while (until the policy is legislated, and then perhaps a little after that as well) should present some good opportunities, as fewer buyers will be competing for properties. Obviously, this will only impact certain segments of the market, with those that are popular with first home buyers most of interest in this regard. I work with a lot of first home buyers, and in recent times have purchased a lot of strata properties in the sub $1.2mil market across Sydney’s Inner West and Inner City. These are a types of property that I feel will definitely present some excellent buying opportunities in the short term, amongst others.

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.