The growth in the Sydney property market in 2023 has come as a surprise to many. In this update, we look at the reasons for this and what’s in store for the remainder of 2023 and into 2024.

Sydney led the market recovery but performance hasn’t been uniform

In 2023, the Sydney property market has again shown remarkable resilience with values increasing 4.9% over the Q2 2023 quarter. As at August 2023, property values are still 7.2% below their peak (January 2022). Recent forecasts indicate an expectation of more growth to come. However, price growth hasn’t been uniform across the city. The days of ‘the rising tide lifts all ships’ are firmly in the rear view mirror.

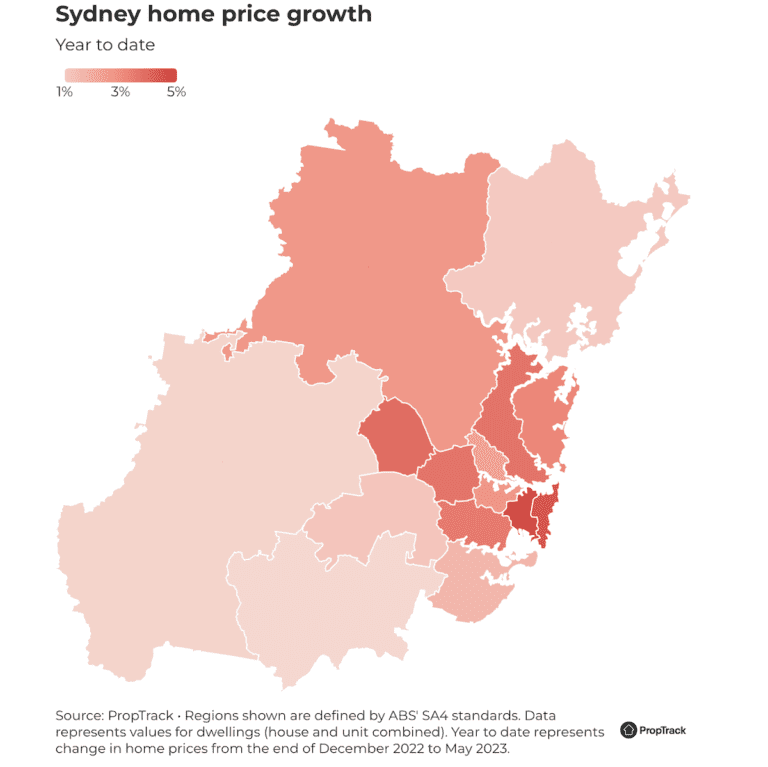

Over the past 3 months, prices for premium properties (top 25%) in Sydney have increased by 5.2%, compared to more affordable properties (lowest 25%) which have only risen 3.0%. Geographically, there’s also been an uneven distribution of price growth. Year-to-date, the highest growth can be seen in the inner city and surrounds.

Why have Sydney property prices increased despite the quickest rate rises in history?

What’s interesting is that property prices have been increasing against the backdrop of the steepest interest rate rises in history and falling overall consumer confidence.

Fundamentally, it’s all about supply and demand. Property markets are like any market. In many parts of Sydney, there’s simply insufficient supply compared to demand. The result is price increases.

Lack of supply continues to plague the market

So, let’s dive into the supply side of things first. While supply is driven by many things, the main factors currently influencing the Sydney market are:

- Overall property listings are below average

- Construction of new homes is low

- Expected listings from mortgage stress haven’t eventuated

- The ‘mortgage cliff’ has had only a limited impact to date

- Listing by investors are increasing in some areas

1. Property listings continue to remain low

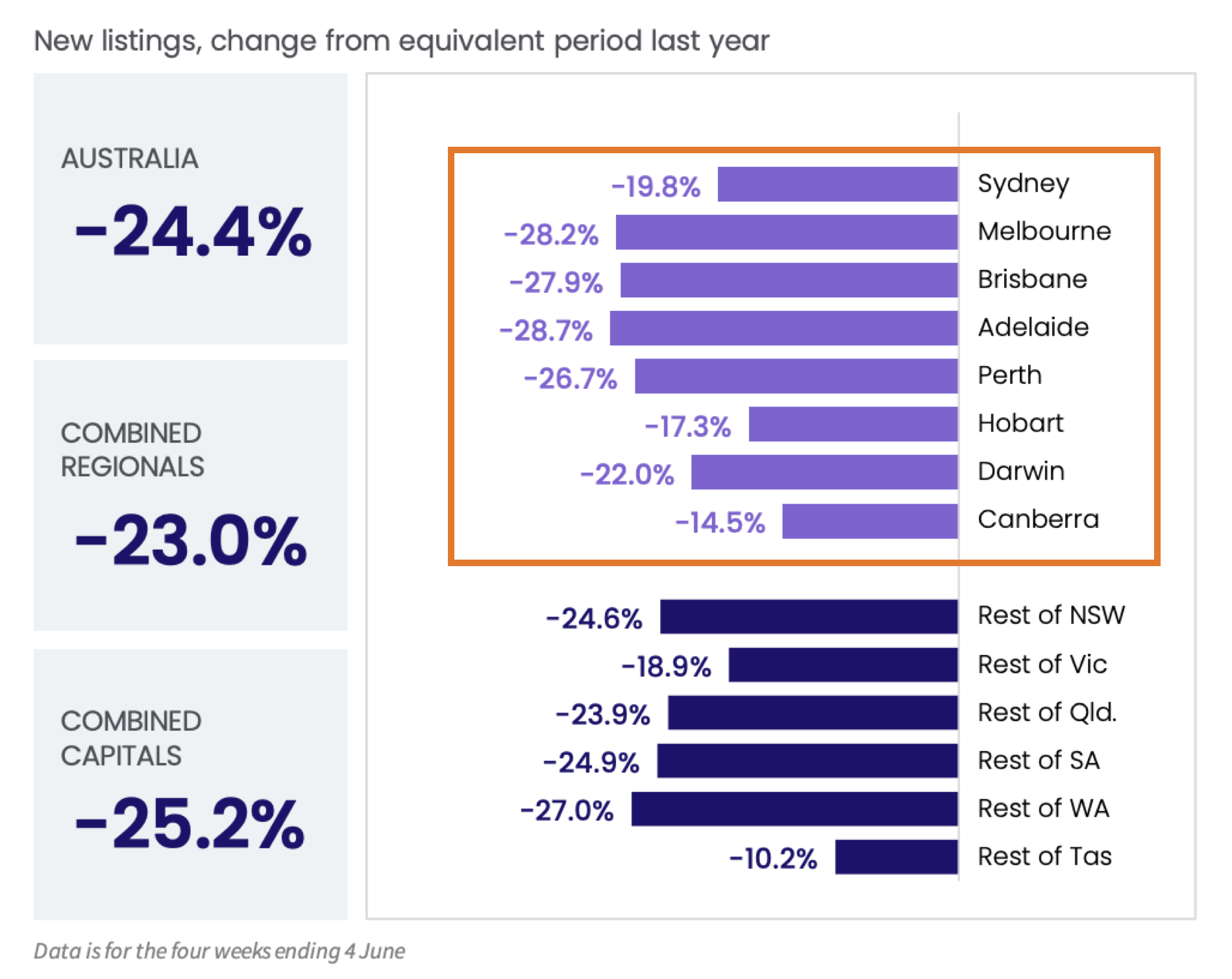

As has been widely reported, property listing volumes in Australia are down substantially on previous years. Corelogic shows double digit percentage declines in each capital city compared to previous years, as shown in the sample period below.

Meanwhile in Sydney, with a few exceptions, each region recorded double digit declines in July compared to last year. Whilst SQM reports some recent indications of increased listings over the traditionally quiet winter months, the lack of supply has had an impact on sales in the first half of 2023.

2. Higher construction prices has limited new supply

During the pandemic, construction prices increased sharply. Since then, there have been countless bankruptcies of building companies across the country – from mum and dad operators all the way up to major home building companies.

These events have contributed to a reduced supply of new properties as developers halt projects with approved plans for almost 16,400 dwellings in NSW that have not started to the end of March.

Rising construction costs also mean new homes are also more expensive to build and buy. This has created upward price pressure on existing properties as they become more desirable.

3. There’s limited evidence of increased mortgage stress – and only in certain areas

The theory is that continuous interest rate rises increases the risk of widespread mortgage stress leading to an influx of distressed listings. However, there’s little evidence to suggest that this has become a reality.

Sydney is a big city with a diverse property market. At any given time, some parts of the city will do well while others might struggle. This is what we’re seeing now. The rapid increase in interest rates has had an unequal effect across Sydney; falling largely along socio-economic lines.

Looking around Australia, the AFR identified Sydney’s south-west and outer south-west as having the highest percentage of households that are more than 30 days in arrears in May 2023.

This map from the SMH shows that these areas largely correspond to those with a higher proportion of distressed listings. An increase in distressed listings can be a precursor to falling property prices – which could put further pressure on these households.

Conversely, in many other areas, demand has been strong. Prices are rising for most types of property. There’s little to suggest this will change – particularly as interest rates are set to peak.

There are many neighbourhoods in Sydney where the typical loan to asset value is very low. These areas aren’t as negatively impacted by interest rates as many commentators might think. According to the RBA, “Many households are experiencing a painful squeeze on their finances, while some are benefiting from rising housing prices, substantial savings buffers and higher interest income.” Additionally, not all property owners have a mortgage. Based on the 2021 census, 26.7% of Sydney households own their home outright, and 31.9% have a mortgage (the remainder are renters).

At this point, alarm bells don’t need to be sounded. This is a cautionary tale to show that not all of Sydney is performing at the headline numbers. A widespread increase in listings – due to higher interest rates – has yet to eventuate.

4. The ‘mortgage cliff’ has yet to result in mortgage stress

There’s been a lot of discussion in recent months about the imminent ‘mortgage cliff’. This is where large numbers of borrowers will roll off relatively cheap fixed rate home loans into substantially more expensive variable loans.

According to the ABC, borrowers will, on average, go from 2-3% on a fixed loan to 6% and over on a variable loan. Their analysis shows the number of impacted mortgages in Australia at 880,000 for 2023 and a further 450,000 in 2024.

Despite rapid interest rates rises, there’s evidence that Australian households have adapted their spending, and utilised savings buffers to help cushion the impact of rising mortgage repayments.

As more households roll off fixed rates, it’s likely more households could become susceptible to mortgage stress. However, according to Ross McEwan (CEO at NAB), “We are starting to see an uptick … where customers have not been able to make a payment, but the levels that we’re seeing are still below the 10-year average.”

5. Traditional investor favourites are feeling the heat

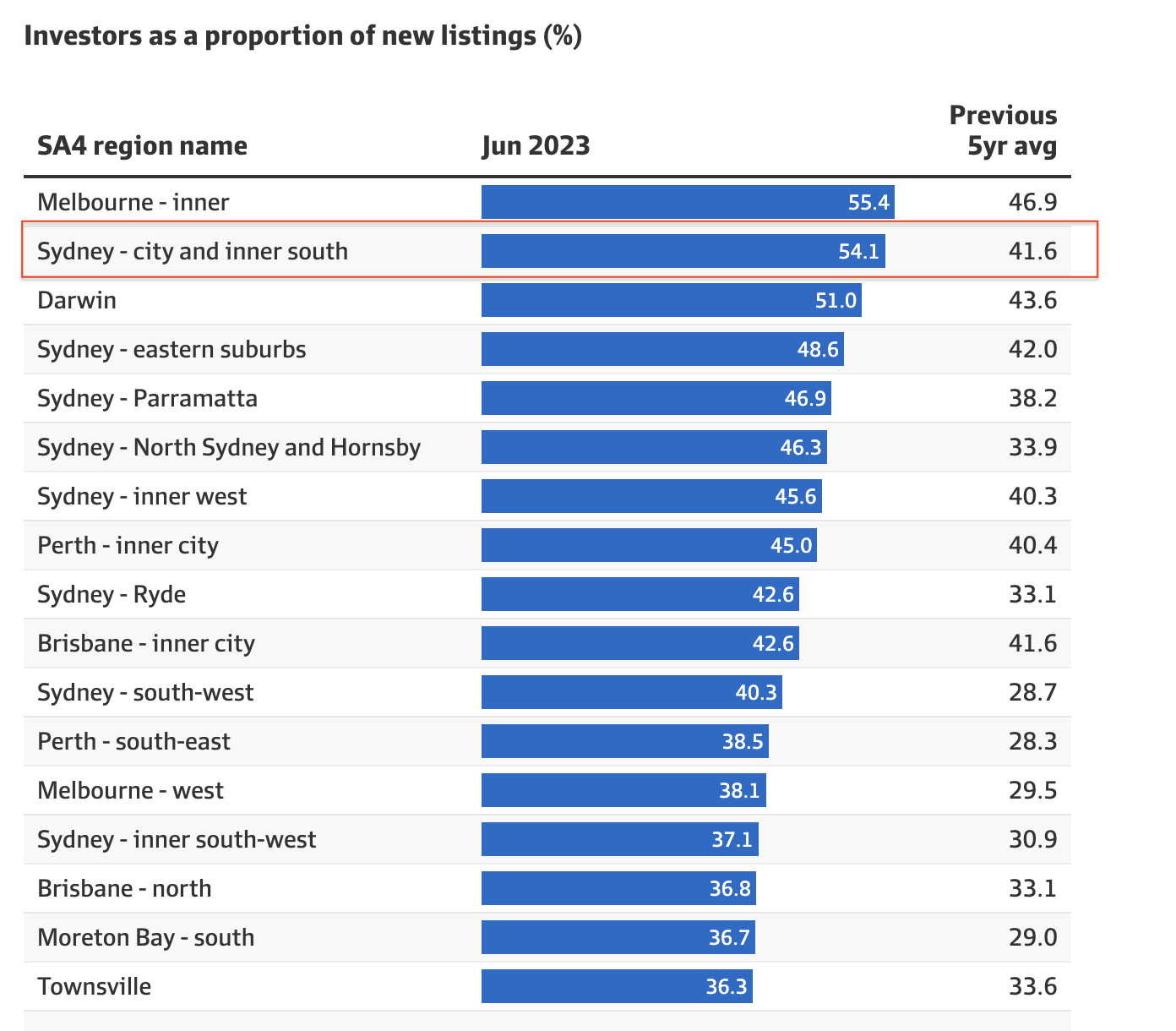

One segment of the market has responded more to interest rate increases – property investors. There’s increasing evidence that many investors are looking for the exit gates. However, so far, selling is limited to certain property types – the ‘go to’ favourite for many Sydney investors – high-density inner-city apartments.

Unlike home owners, investors aren’t generally as attached to an investment property. The hold or sell decision becomes more of a pragmatic business call. Across Australia, since the start of 2023, new investor listings as a share of total new listings have increased sharply; suggesting the tipping point has been reached for many. Rising interest rates make holding an investment property substantially harder despite increases in rents.

In Sydney, this phenomenon is largely isolated to one particular segment, namely high-density apartment markets. In the Inner City/Inner South, investors make up 54.1% of listings; while Parramatta and North Sydney/Hornsby have also seen large increases in investor listings over the previous 5-year average.

These areas contain a large proportion of high-density properties which are often purchased by investors; buoyed by promises of high yield, high depreciation, and even rental guarantees. However, these units lack scarcity and owner occupier appeal – both of which we look for in any investment property.

Not all investors are feeling the heat. In fact, many are looking to enter the market despite the doom and gloom from some parts of the media. Whilst the above table suggests there are pockets dominated by investors under selling pressure, many other investors are doing well by targeting owner-occupier dominated markets. We’ve seen very solid results for our Sydney investor clients, with a substantial increase in interest from investors looking to benefit from expected long-term price growth in the Sydney market.

Strong demand creating competition among buyers

On the demand side, the main factors driving demand in Sydney include:

- A strong rental market leading to increases in first home buyer demand

- Return of FOMO

- A shift to smaller households

1. Higher migration has increased rental demand with a flow on effect to the wider property market

Australia’s net migration intake has increased dramatically over the last 12 months. This has an obvious impact on the rental market, mainly in Sydney and Melbourne, which are home to the majority of new migrants.

This has also had a wider impact on the property market. When new migrants settle in Australia, many traditionally enter the rental market rather than property ownership. The rise in net inbound migration has resulted in increased demand in the rental market (though it’s not the only driver). Rents have increased substantially over the last year, with Sydney house rents up 12.9% over the year to June 2023, and units up a staggering 27.6%. One consequence of this rapid rise in rents has been the re-emergence of the Sydney first home buyer.

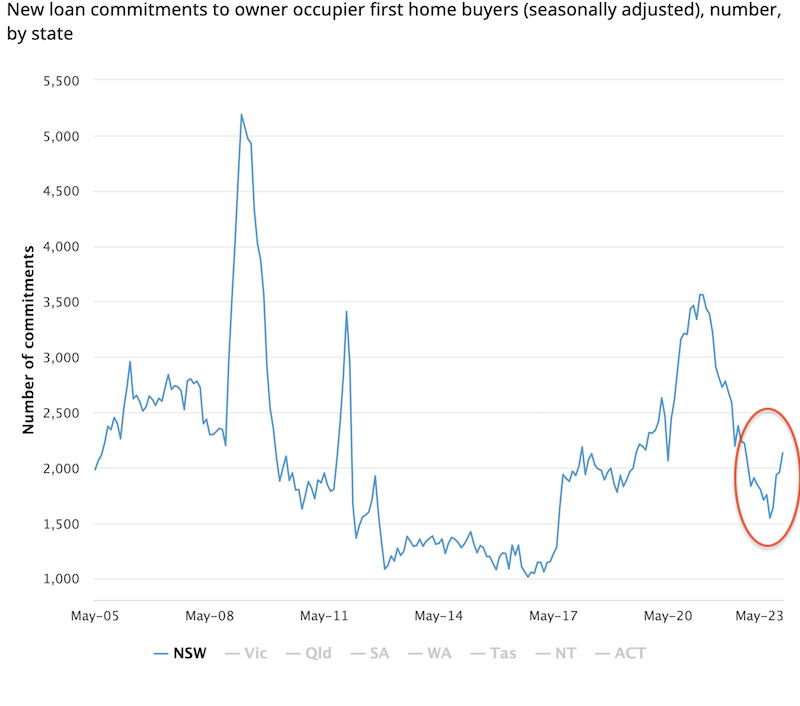

Faced with increased rents and a tight rental market, many have decided to look at entering the property market. Tim Lawless, from CoreLogic, suggests, “The rise in first home buyer lending could point to more renters fast tracking their home purchasing decision if they have financial ability to do so.”

Obviously this isn’t an option for everyone. Finding a deposit (even with new stamp duty changes) is increasingly difficult. However, the increase in the number of new loans to first home buyers shows that they have started returning to the market.

Recent stamp duty changes have also seen a marked increase in first home buyer activity. The sharp rise in first home buyer loan commitments from January 2023 coincided with the introduction of the ‘NSW First Home Buyer Choice‘ policy (which has since been phased out). The policy allowed for first home buyers to choose a yearly property tax instead of the traditional upfront stamp duty. This helped generate significant demand in the sub $1.5 million market in Sydney, as the upfront cost of properties was effectively reduced.

This policy has since been replaced by a new ‘First Home Buyer Assistance Scheme‘, which allows NSW first home buyers to purchase property up to the value of $800,000 without paying stamp duty, and concessional benefits for properties between $800,000 and $1million.

Tight rental markets, along with a time-limited demand side policy, has helped propel certain property markets in Sydney – particularly those below the $1.5million mark.

2. The return of ‘FOMO’

One of the most interesting phenomena in the Sydney property market over the first half of 2023 has been the re-emergence of ‘FOMO’ – fear of missing out. Whilst not at the levels as it was during parts of 2020, it’s been a noticeable trend on the ground. Buyers are paying more to secure a property due to a lack of available options in the market.

Anecdotally, from our mortgage brokers contacts, another driver of FOMO is the ‘re-rating’ of potential borrowers by their lenders during pre-approval updates. The quick rise in interest rates can affect a borrower’s ability to service the debt. As a result, they face a potentially lower borrowing capacity if they need to re-apply for a pre-approval.

As a result, many buyers are rushing to buy before their pre-approval lapses for fear of being priced out of the market. This is expected to ease moving forward as we enter a more stable interest rate environment.

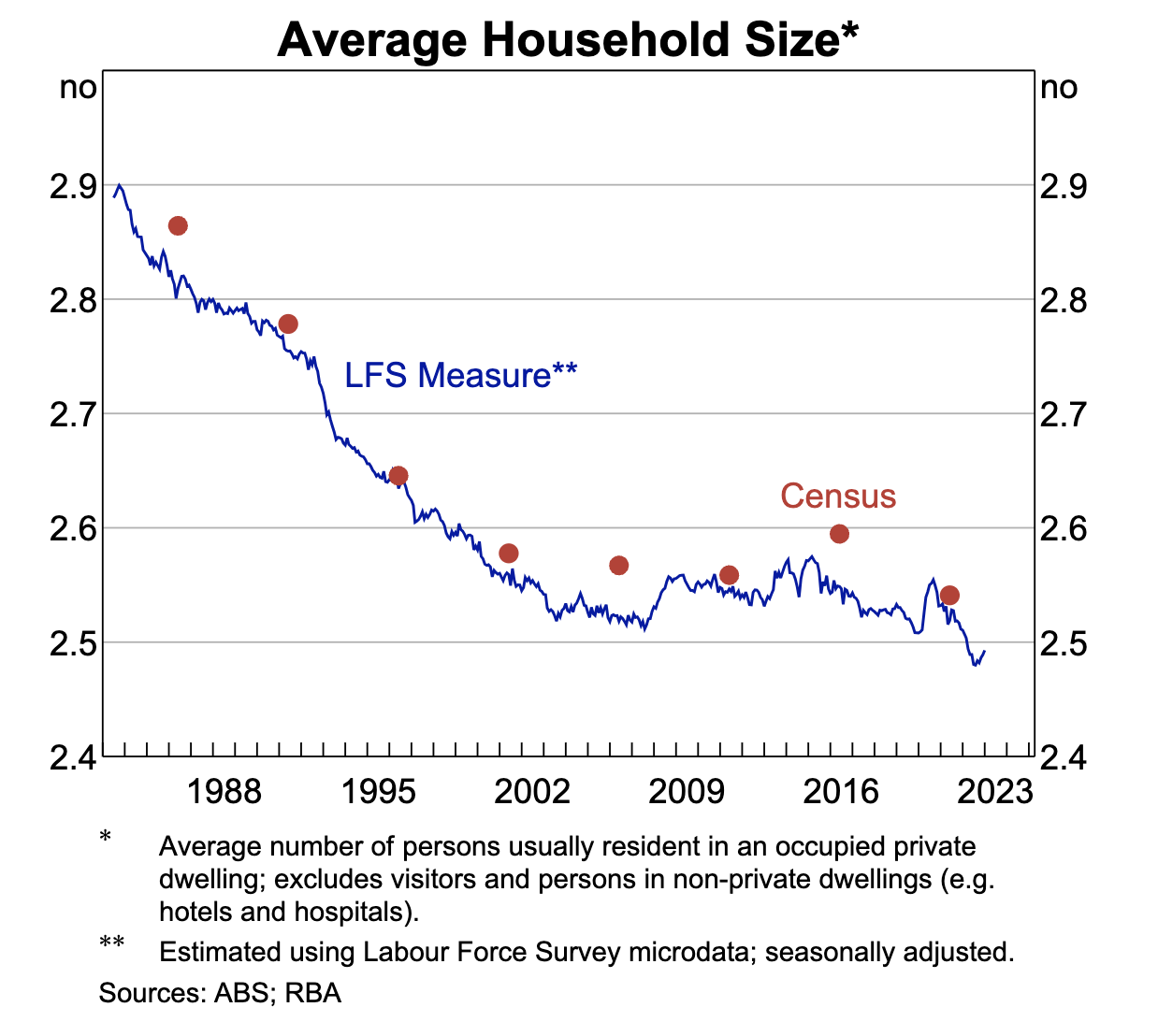

3. More of us are living alone – adding to overall demand for dwellings

The average household size has steadily decreased over recent years, and this trend accelerated during the Covid pandemic. According to research by the RBA, “every one percentage point decline in average household size in Australia created an additional 120,000 new households”. This contributes to increased demand for both rentals and property buyers.

What does the future hold?

Moving forward over the remainder of 2023 and into 2024, Sydney will continue to be a property market with mixed fortunes. There will be opportunities for both investors and home buyers – but as always, location and asset selection will be key.

We expect to see a number of main trends in the Sydney property market moving forward:

- Rental growth easing

- Improved buyer confidence

- A likely rise in overall listing volumes

- Continued undersupply

- Price growth

- Strong demand in the sub $1 million market

1. Rental growth to ease

We expect continued strength in the Sydney rental market. However, rental prices will reach a point where renters can’t afford to pay more. Unlike home buyers, tenants don’t generally borrow to be able to pay the rent. This means there’s a natural ceiling to how much they are willing and able to pay.

This tipping point is different for every property type in every suburb. Tim Lawless from Corelogic suggests, “Affordability pressures could be a factor in forcing a change in household formation, as renters once again form larger group households in an effort to spread their rental costs across a larger number of tenants.” However, with demand remaining high and no clear evidence of increasing supply, the rental market is likely to remain very tight across the city.

2. Buyer confidence to improve as the interest rate cycle nears its peak

As at the start of August, there’s general market consensus that we’re near the top of the current rate tightening cycle. In fact, some economists, including Westpac’s chief economist, Bill Evans, are forecasting future decreases: “The next move is now likely to be the first cut in the cycle which is forecast for the September quarter of 2024.” Any medium term stability in the interest rate market is likely to improve overall confidence in the Sydney housing market.

It’s also important to note that any increase in unemployment would be expected to impact the mortgage belt more than other parts of Sydney. This is definitely a risk that needs to be taken into consideration for those considering purchasing in these areas.

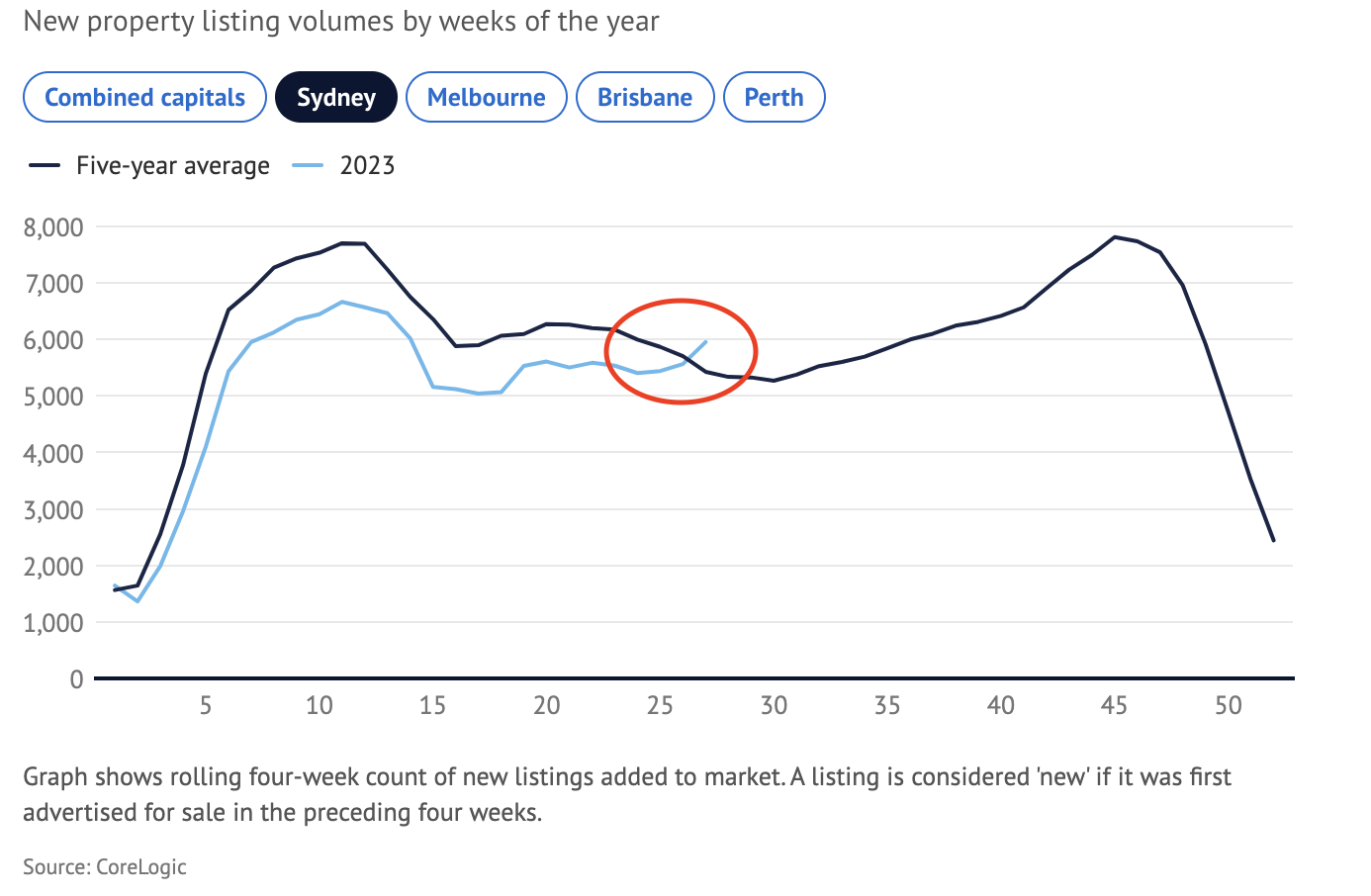

3. Indications of listings volume increasing

For the first time in 2023, the number of property listings in Sydney recently surpassed the five year average. Any sustained medium term increase in listings in spring should see the pace of property price growth decline. This should also dampen some of the ‘FOMO’ that has been evident in the market in the last few months.

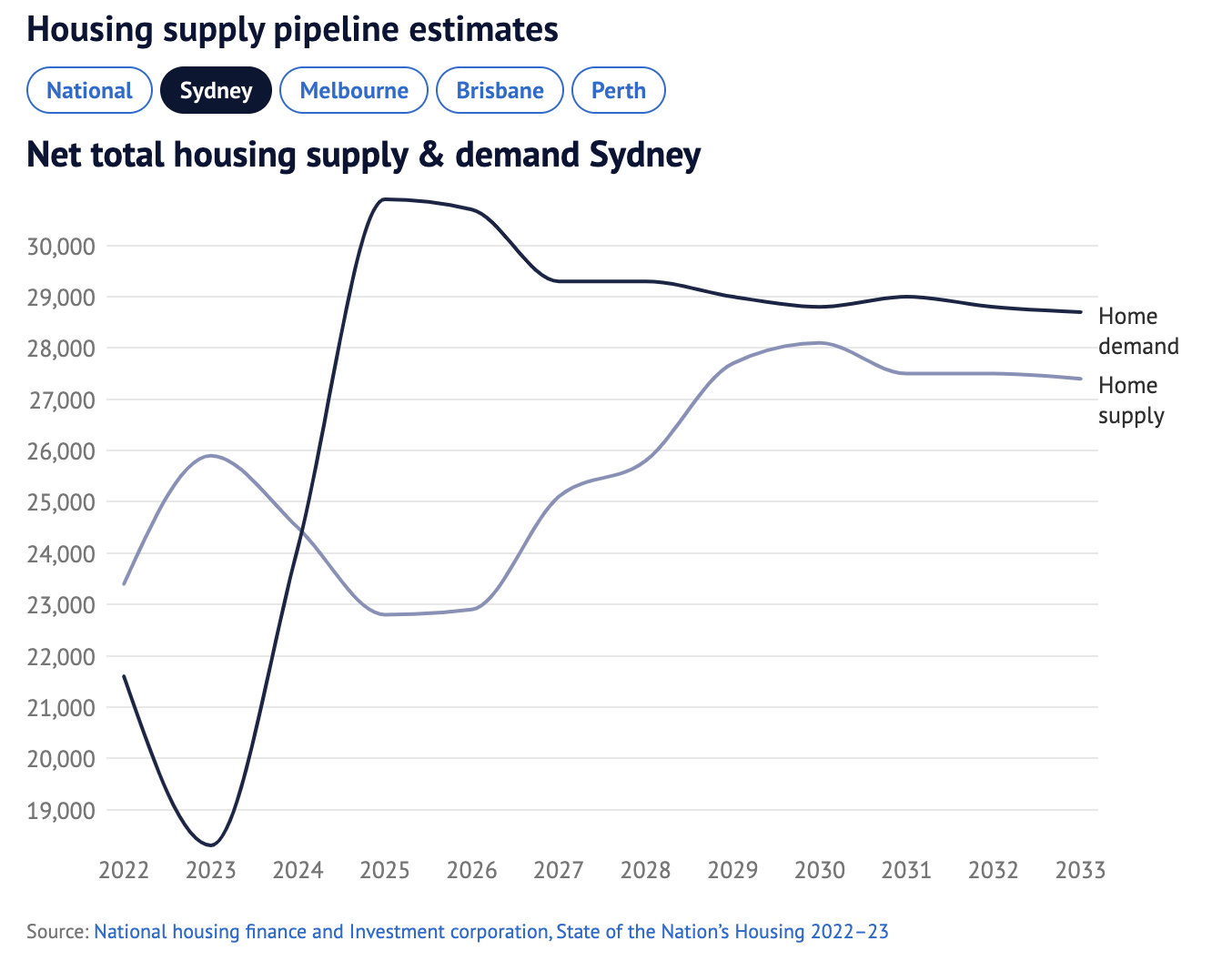

4. Continued undersupply of property in the greater Sydney region

Based on most recent budget forecasts of migration intakes and current building approvals data, housing undersupply will unfortunately get worse before it gets better. The graph below shows the extent of the gap between supply and demand for renting and buying. This will only contribute to upward pricing pressure in many parts of Sydney. Over the long term, the Sydney property market will remain undersupplied unless there is a dramatic adjustment in government policy.

5. Prices are likely to increase over the next 12-18 months. However, some areas are set to miss out

Moving forward, for the remainder of 2023 and into 2024, we expect more established/lower density suburbs in the inner ring and coastal areas of Sydney to outperform the wider Sydney property market. Vendors typically have significant equity in their properties and are less affected by mortgage stress. Meanwhile, buyers often have significant deposits and strong serviceability, allowing them to push prices up.

Even though official rates look to be levelling out, the full impact of interest rate rises hasn’t been felt yet as there’s a delay for lenders to pass these increases onto borrowers. In areas with higher loan to asset ratios, there’s concern of property price falls.

Traditional mortgage belt corridors, with lots of new entrants in newer city fringe estates, may see affordability challenges. There will likely be some downward pressure on prices in some of these areas despite the overall supply and demand situation.

In addition, many suburbs, dominated by investors in high-rise units, will likely continue to be under pressure despite the tailwinds from increasing rents and higher immigration numbers.

6. Strong demand to in the sub $1 million market

Entry level, sub $1million first home buyer markets should continue to show strong demand, underpinned by the new First Home Buyer Assistance Scheme. These markets also tend to be favourites of investors, and we expect investor demand to further improve when the current interest rate tightening cycle completes.

Whilst in a general sense, the Australian property market deals in supply and demand like any other. It’s also unlike any other asset market, because the main players are everyday Australians – not investors.

Yes, there are some markets where property investors are dominant (we actively avoid these areas!), but in general it’s homeowners who are setting the prices. As such, the property market doesn’t always respond in the way that many forecasters and commentators might think.

The diversity of the Sydney property market means you have to understand both the broader macro-level drivers, as well as the circumstances surrounding each local suburb. Armed with this information, you can make better choices about which property to buy.

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.

About

At The Property Curator, we believe that good buying involves a strong understanding of the local property market. We combine data and expert-backed analysis with on-the-ground insights and agency relationships to help our clients buy the right property for the right price. If you’d like to discuss buying property in Sydney, call us on 1300 989 466 or email us today.