It’s been a big couple of years for the Sydney property market, but units have underperformed

One of the key features of the Sydney property market over the last couple of years has been the general outperformance of houses compared to units. As an example, according to CoreLogic, over the 12 months to January 31 2022, Sydney house prices grew by an average 29.8% compared to 15.4% for units. The gap between house prices and unit prices is now at an all-time high.

This pricing disparity is also apparent at the national level:

“…although house growth has traditionally outpaced unit growth over the past decade, the performance gap throughout the current upswing has been notably higher than in previous cycles, thanks in part to COVID-related demand shocks disproportionately affecting unit demand.”

Kaytlin Ezzy, CoreLogic

(source: CoreLogic)

Focusing again on Sydney, the below graph shows the Sydney house price premium compared to units, in percentage terms. It’s clear that from early 2020, the premium has increased dramatically. Whilst it’s no real surprise that houses were the preferred option for many during a pandemic, it is notable how much the gap has increased over the past two years.

Source: PropTrack

This increasing gap between houses and units means first home buyers may need to focus their attention on units as opposed to freestanding houses as an option to get onto the property ladder. This issue isn’t just impacting first time buyers, it’s also making upgrading a home substantially more difficult for those who are looking to make the shift from unit living, as noted in this article.

“Long gone are the days of graduating from a unit to a house, with many now forced to buy another strata property, whether it is a bigger unit or a townhouse… ”

Tawar Razaghi, Domain

(source: Domain)

Anecdotally, in my business (chiefly focusing on the Inner West and nearby areas), I’m seeing a lot more clients considering units, as it’s often the only way for them to enter the property market in the suburb(s) of their choice. This has been a consistent trend throughout 2021 and now into 2022.

Whilst units have underperformed compared to houses, they’ve still shown solid price growth over the last couple of years. I expect there to be continued growth for Sydney units this year, however it certainly won’t be evenly distributed. I also expect increased investor activity in the Sydney unit market, driven by a number of factors, which are outlined below.

Sydney unit rents have struggled in recent years, but things are changing

Property prices, whether it relates to determining the price of a property for sale or for rent, ultimately comes down to supply and demand. Demand itself is a function of how much people are willing AND able to pay. Over the last couple of years, particularly in the inner city unit market, the potential tenant pool has shrunk. Some renters left the country during the pandemic, others moved interstate/into the regions, and some left the market altogether (either by purchasing their own home or potentially returning to live with parents). Many also saw their weekly income decrease as a result of the pandemic. These factors, combined with new stock coming online, saw rents decline in many city and city fringe unit markets.

In recent times, however, rents have started to climb. I expect unit rents to continue to increase, as vacancy rates decline in many parts of the city.

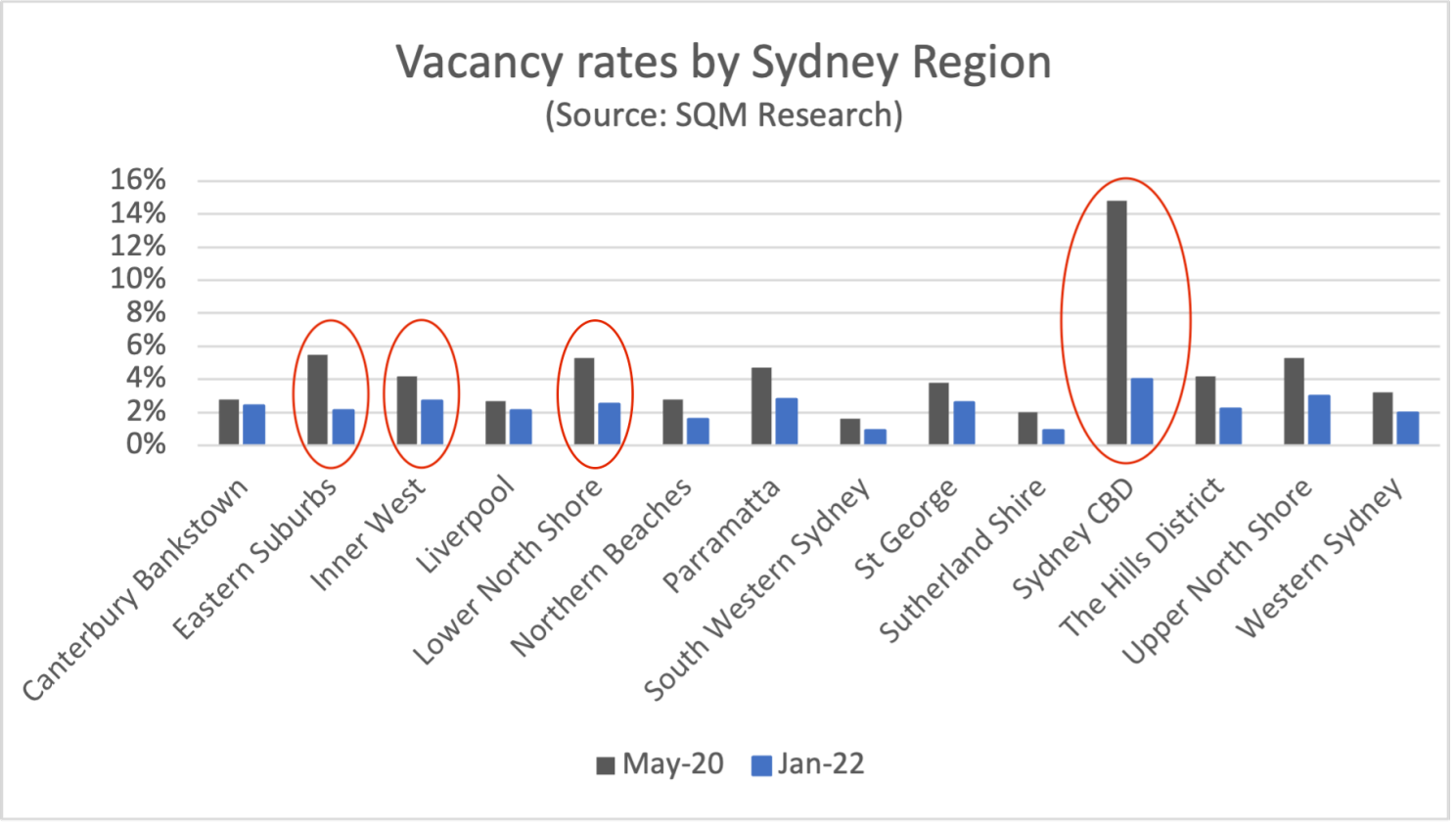

Vacancy rates are on the decline, particularly in the inner city markets

The below graph is a snapshot of vacancy rates (all dwellings) for the major geographical areas across Sydney. I’ve chosen to compare the months of May 2020 (identified as the peak vacancy rate for Sydney as a whole), and January 2022 (the latest available data).

Whilst it’s not possible, using this data, to isolate the vacancy rate for units alone, it does paint a picture that the pandemic had a strong impact on vacancy rates on the city and city fringe markets, which also tend to have a higher concentration of units. The above graph highlights the rebound in some of these markets, such as the Eastern Suburbs, the Inner West, as well as the Sydney CBD itself.

Inner city unit inventory is slowly being absorbed

The rental equation is just one part of the story. Another important aspect relates to the amount of stock available for sale at a particular time. Things seem to be tightening in this regard as well, with unit inventory (measured by months of stock) slowly but steadily declining, as shown below.

Source: Suburb Trends

(“Sydney Inner City” SA3 includes: Darlinghurst, Erskineville, Alexandria, Glebe, Forest Lodge, Newtown, Camperdown, Darlington, Potts Point, Woolloomooloo, Pyrmont, Ultimo, Redfern, Chippendale, Surry Hills, Sydney, Haymarket, The Rocks, Waterloo and Beaconsfield)

As the city continues to return to life, I expect more people will re-consider inner-city living. Combined with the re-opening of the borders to new migrants (who often prefer to live near the city), I expect to see a further increase in demand for inner city property, from both a rental and purchasing demand point of view.

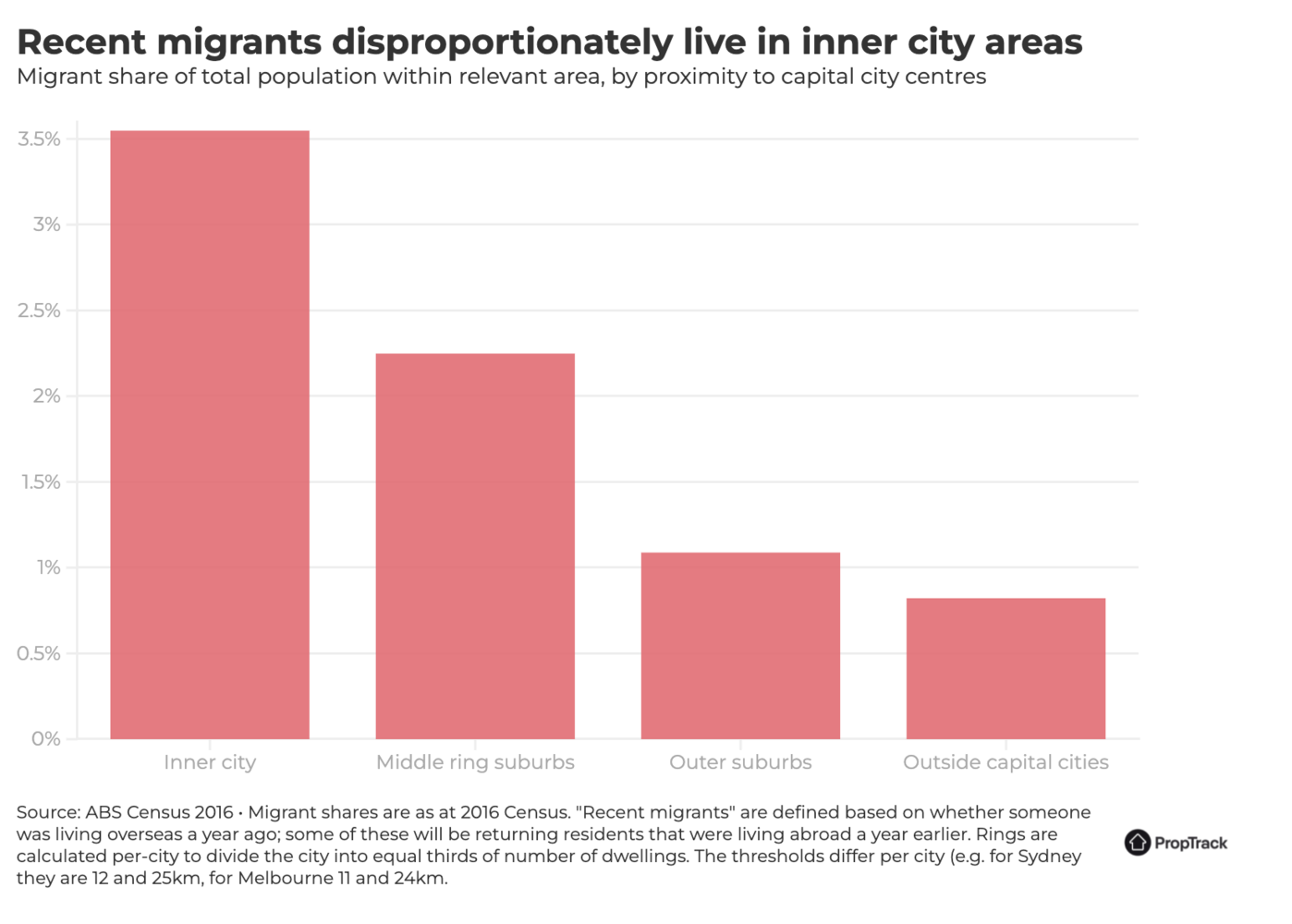

The return of international migrants is expected to provide a boost for inner city unit markets

After almost 2 years, the borders re-opened on February 21 to eligible tourists, as well as those looking to call Australia home. The inner city property market has been particularly hard hit by the absence of new international migrants, as well as the exodus of international students (many universities are located close to Sydney’s CBD area). Sydney is often a gateway city for new arrivals to the country, with NSW accounting for 33.9% of overseas migrant arrivals for the year ending June 2020, according to the ABS.

As seen in the below graph, recent migrants heavily favour initially living in inner city areas.

Source: PropTrack

From a rental perspective, given most new entrants to the country initially rent, this is seen as good news for Sydney landlords. Whilst recent migrants are more likely to look to rent than to buy, the positive impact on rental markets is also expected to help provide support for property prices in these markets, to the degree that investors are competing for stock.

The combined impact of the continued re-opening of the city to business, the resumption of international migration, and the impact of “reverse migration” from the regions to the city are all expected to positively impact the inner city unit market.

However, not all units are created equal…

The above analysis provides support for expectations that some units will perform quite well throughout 2022. However, that’s not to say the entire Sydney unit market will thrive. In some pockets, there will continue to be a general oversupply of units, and some buildings in particular will continue to struggle to attract buyers. That’s particularly evident for some of the developments that were heavily targeted at off the plan investors, or any that have had significant publicity around building defects.

In general I’m very cautious on high-rise buildings, investor stock, and generally any unit that doesn’t have strong owner occupier appeal. I continue to prefer small boutique buildings in established areas, close to lifestyle amenities and within an easy commute to job centres. I’m also focused on finding areas that aren’t likely to be over-run by new developments in the medium to long-term.

Property wise, I’m looking for relatively large units with functional floor plans. They must have good natural lighting, reserved parking, and a nice balcony/outdoor space. Basically, I’m looking for properties that have a far bit of scarcity, and I’m avoiding ‘cookie cutter’ style developments. Finally….it’s really important to find somewhere with decent strata levies, in a well run building.

Where to from here?

As I noted in my January 2022 newsletter, the pace of growth in Sydney property prices has decreased substantially in recent months. In January, CoreLogic recorded median price growth of 0.8% for houses and 0.1% for units for Sydney. Looking forward, I don’t expect there to be anywhere near the same level of growth for the market as a whole in 2022 that we saw in 2021.

Affordability concerns, the impact (perceived and real) of any interest rate rise, and the impact of the upcoming federal election should be enough to keep a lid on substantial across the board price growth.

However, I feel that certain segments of the market will still perform well. In particular, given their ‘relative’ affordability, I expect to see some units do quite well in 2022. Tightening vacancy rates, increasing rents, and the return of migrants should help to support demand for this asset type, compared to the previous couple of years.

As always, it’s important to urge on the side of caution when looking at a unit to purchase, whether to live in or as an investment. The divergence between a-grade assets and non a-grade stock is stark. For investors, there are continued opportunities in select parts of Sydney, however they need to be conscious of holding costs. Expected rental increases will be welcomed by landlords, however these need to be considered against likely increased interest rates.

See you next month.

Brendan

This article was originally posted on LinkedIn.

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.