Australia wide, rental markets are tightening dramatically and rents are on the rise

Across the country, vacancy rates in most markets continued to decline over 2021 and now into 2022. According to recent analysis by the Ray White Group, “Australian rent costs were now increasing at the fastest pace since the Global Financial Crisis 14 years ago”. SQM Research, arguably Australia’s most well known provider of residential vacancy rate data, recently noted that Australian vacancy rates are at 16 year lows.

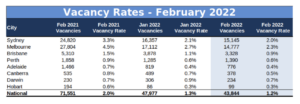

Nationwide, the February 2022 vacancy rate stood at 1.2%, with six capital cities recording vacancy rates below 1%. Hobart recorded a mere 0.3% vacancy rate, Adelaide 0.4%, and Canberra 0.5%. Given many commentators note a balanced rental market is one that has a vacancy rate of between 2% and 3%, the below figures shows just how tight the capital city rental markets are. As vacancy rates decline, upward pressure on rents increases. SQM reported that capital city asking rents increased by 9.4% over the year to February 2022. SQM are also forecasting capital city rents to increase “over 10% in 2022”.

Source: SQM Research

The above analysis focuses on the capital city market, however the rental crisis in some regional areas is actually worse than those being seen in Australia’s capital cities. In fact, Corelogic reported that combined regional area rental rates increased by 11.0% over the year to February 2022.

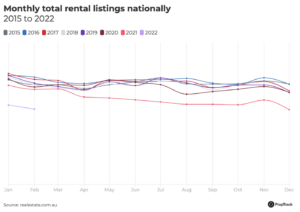

The below graph provides some useful context to understand the supply side of the Australian rental market. As can be seen from the light purple line, the January and February 2022 monthly total national rental listings continued the downward trend established in 2021 (pink line). This lack of supply is a key reason for the continued decline in overall vacancy rates.

Source: PropTrack

Source: PropTrack

“Given a dramatic tightening in vacancy rates, we are seeing an ongoing acceleration in weekly market rents across the capital cities. This situation now represents a significant rental crisis across the country.”

Louis Christopher, SQM

(Source: SQM Research)

2021 was a year of capital growth for Sydney; 2022 is shaping up as one of rental growth

As I noted in my January newsletter, Sydney saw mind boggling capital growth last year of 25.3%. As rents failed to keep pace, the Sydney gross yield fell to 2.42% (December 2021), according to Corelogic. For anyone accustomed to cash-flow investing, this yield figure would likely elicit some sort of dramatic reaction. However, with vacancy rates declining across most of the city, and the growth of 2021 behind us, it’s likely that rental increases will start to see gross yields improve, albeit from a low base.

As you can see from the below graph, the total rental listings for Sydney declined almost 23% in February, against the same time last year. This decline in listings (rental supply) will put additional pressure on a market that is already experiencing a tightening rental market.

Source: PropTrack (note: GCCSA = Greater Capital City Statistical Area)

Source: PropTrack (note: GCCSA = Greater Capital City Statistical Area)

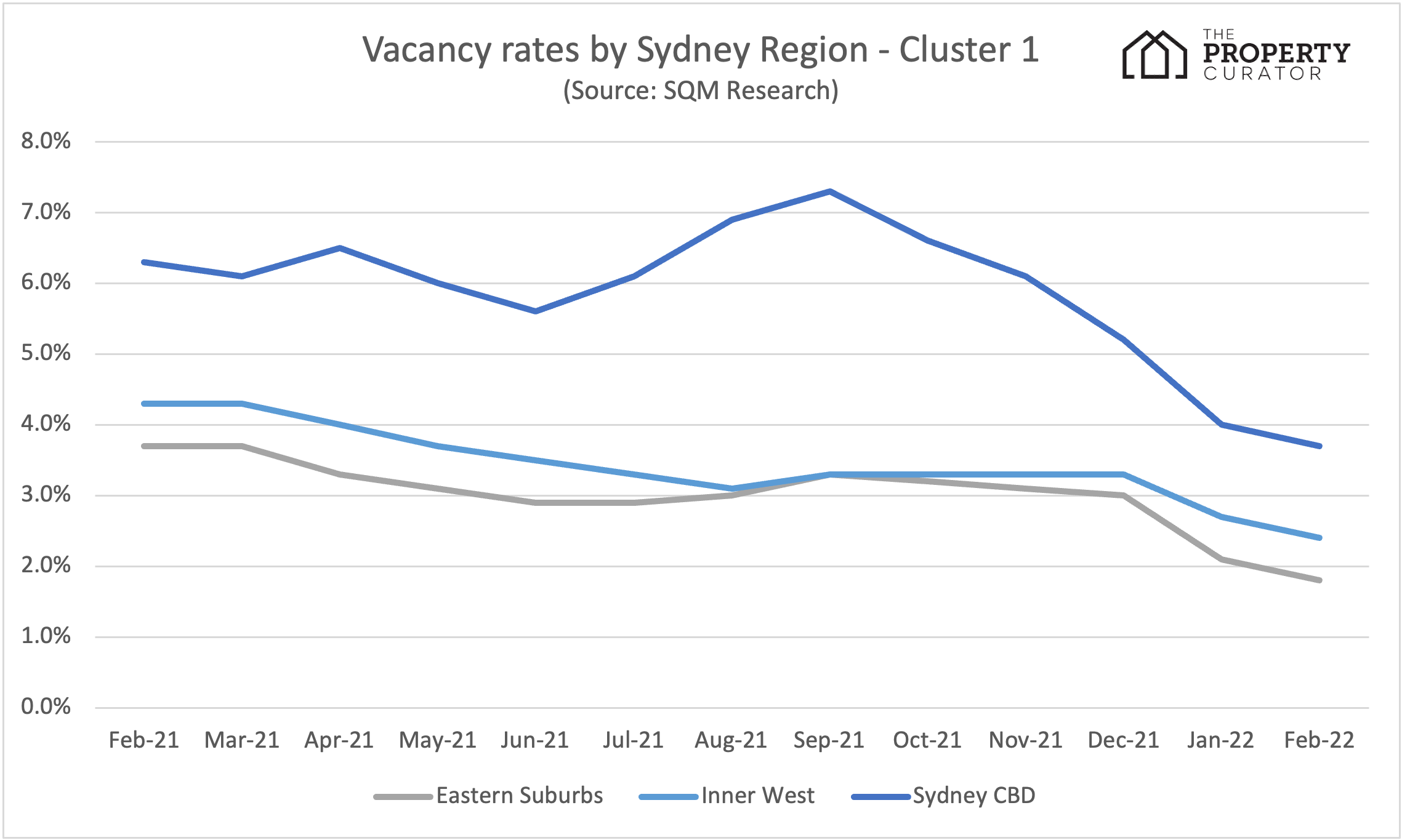

Using the latest available SQM Research vacancy rate data, I’ve done some analysis that looks at Sydney vacancy rates over the past 13 months. In order to more easily understand this information, I’ve created some loose geographic clusters, as below:

- Eastern Suburbs/Inner West/Sydney CBD

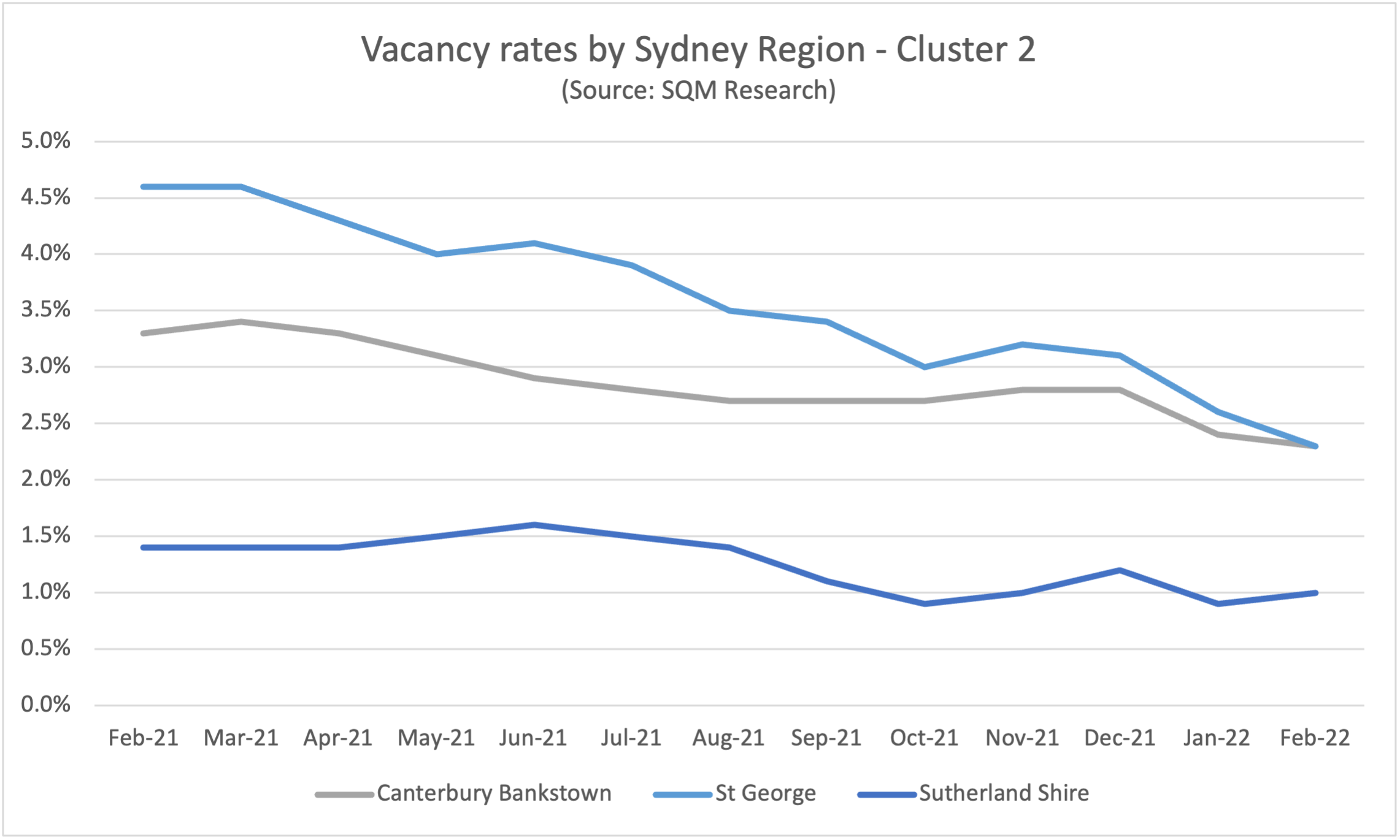

- Canterbury Bankstown/St George/Sutherland Shire

- Liverpool/Parramatta/South Western Sydney/Western Sydney

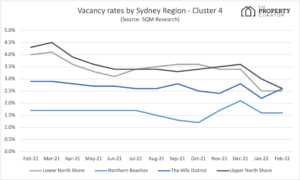

- Lower North Shore/Northern Beaches/The Hills District/Upper North Shore

Now, these are only high level clusters, based on the geographic regions nominated by SQM. I acknowledge it’s a fairly rough and ready analysis, but it still allows us to highlight some important factors at play. One thing to note, these vacancy rate numbers reflect all dwellings. That is, there’s no reliable (that I know of) long term vacancy rate data that shows units and houses separately. If anyone knows of any, please let me know!

The Inner City was one of the hardest hit areas during Covid, and vacancy rates increased significantly from early 2020 onwards. As can be seen from the above graph, the vacancy rate for the CBD area has declined dramatically from around September 2021. From December, all of these three areas saw declining vacancy rates. This generally coincided with the re-opening of borders to students and skilled migrants.

The Shire has seen quite low vacancy rates over the last few years, and Covid did little to impact this. In fact, similar to somewhere like the Northern Beaches, a number of factors conspired to make somewhere like the Shire quite an attractive proposition for tenants. The Canterbury/Bankstown and St George regions are also seeing steady declines in overall vacancy rates, and both would now be seen as having a balanced rental market.

Focusing on the western part of the city, the standout is the performance of the Parramatta region. From a peak of 5.3% in December 2020, Parramatta now has a vacancy rate of 2.6%. As more units come online, the amount of rental stock will increase, however it’s clear that this previously oversupplied rental market is also now tightening quickly.

North of the bridge, the Northern Beaches and The Hills have been relatively stable over the past year, and the North Shore has seen vacancy rates gradually decline.

Wrapping up

So, what does this all mean for Sydney property buyers, tenants and landlords? From early/mid 2020, a few regions in Sydney saw quite dramatic spikes in rental vacancy rates. No where was more impacted that the CBD market. However, over 2021 most regions saw a gradual tightening in their rental markets. From December, there was quite a noticeable change, and I’d point to a change in border policy as being one (but not the only) factor in this. This general tightening is expected to continue, as I highlighted in my February newsletter.

As we wrap up the first quarter of 2022, it’s increasingly apparent that the rental market across Sydney is continuing to tilt toward undersupplied in many parts. Inevitably, this will mean upward pricing pressure on rents. Expect to hear a lot more about this in the media over the next few months, especially as it becomes an election issue. People who were priced out of areas from an ownership perspective will increasingly be priced out from a rental perspective, and I really feel this is something that needs to be addressed by all layers of government, to address the ‘chronic failure’ in the current system.

See you next month.

Brendan

Please note: the above information and analysis does not constitute financial or property advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or purchasing decision should be undertaken on the basis of this information without first seeking qualified and professional advice.