I’ve written a lot recently about the importance of capital growth and how I believe that it should be the focus for property investors, especially early on in their investing journey. If you read these articles you’ll also notice I touch on the importance of yield, and it the role it plays in a balanced portfolio.

My style of investing is based on a framework approach, and yield is a very important part of the equation. However, I don’t advocate blindly following the cash-flow positive crowd and jumping into residential markets based solely on the fact that a property has a +6% yield. I think a far better approach is to first seek areas that have all the requisite capital growth drivers in place, and then look for properties that have attractive yields. On occasion I also advocate undertaking cosmetic renovations to improve yield and capital value, depending on the property and the investor’s strategy.

So, what is yield?

Put simply, yield is the annual rent of a property divided by the value of the property. So, if a $400,000 property has a current weekly rent of $350, the yield would be 4.6% ($350 x 52 = $18,200. $18,200/$400,000 = 4.6%).

Things to note:

- In residential property, generally we refer to yield as Gross Yield. That is, we take the yearly rental figure and don’t account for any vacancies or costs. Yield is simply the weekly rent, multiplied by 52 weeks and then divided by the value of the property at that point in time.

- In commercial property, it’s common to also discuss the Net Yield of a property, Net Yield takes into account some of the running costs of the property, such as property management costs, rates, levies etc. In the commercial property space, leases specify which party (landlord or tenant) is responsible for which costs (also known as outgoings). It’s possible to find leases where tenants are responsible for paying for 100% of outgoings, in addition to their rent.

A common rule that some investors adopt is to look for properties where the weekly rent is the same or more than the property price, divided by 1,000. Using the above example of the $400,000 property, this would mean the investor is looking for a property with a weekly rent of at least $400. Therefore, the gross yield they’re looking for is more than 5.2% ($400 x 52 = $20,800. $20,800/$400,000 = 5.2%). There’s nothing magic about this number, but it’s a simple heuristic to follow and that’s why it’s so popular.

Yield, by itself, is not enough

Yield is an important measure, but it’s important to understand that yield is simply a representation of a property at a point in time. It doesn’t reflect the history of a property, nor predict the future of a property. That’s why I believe it’s critical to adopt a more balanced framework to selecting properties to invest in, rather than simply finding high yielding properties. In fact, finding areas that have always displayed very high yields may actually, paradoxically, be a warning sign.

Let’s take a look at an example of a suburb that traditionally is seen as a high yielding location, Ipswich.

Note: As we’re looking at weekly data, presented on a monthly basis, in each of the below graphs I’ve taken the first week’s data to represent the month. In each case I’ve used Asking Weekly rents as the proxy for weekly rent, and Asking Sales Price as the proxy for price.

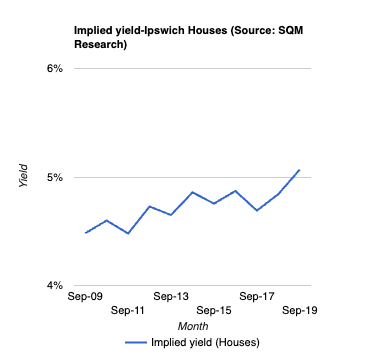

The below chart shows the yield for Ipswich over a 10 year period. You’ll see it’s been gradually trending upwards.

As we noted above, yield is simply the relationship between rents and property values, so to get an understanding of why yield has moved over time, we need to understand what has happened to both rents and property values in a particular area.

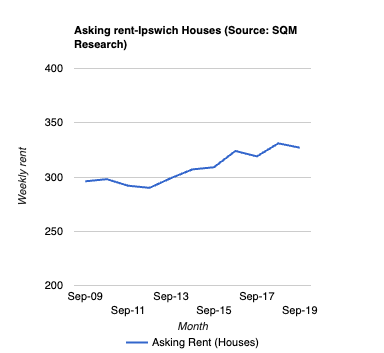

The below chart shows the asking weekly rents for Ipswich, which have increased by an annual rate of around 1% over the time frame. Total growth over the period was 10.5%.

The other chart we’re interested in is what’s happened to house prices in Ipswich. The below chart shows the asking price changes over the same period, and this actually shows a slight decline, with an average growth rate of -0.2% (total decline 2.3%). It also shows a certain amount of volatility in asking prices over time. This is largely consistent with data available from Realestate.com.au.

As we can see, yields in Ipswich have slowly increased over the ten year period, however this is partly due to a slight decrease in property prices, not just to an increase in rents. The fact that yields can increase due to property prices decreasing, not just because of rents increasing should provide a lesson on the dangers of relying on yield as a measure of the investment potential of an area.

Finding areas that show high yield but few capital growth drivers, in my opinion, isn’t a good strategy to create a long-term sustainable property portfolio. Luckily, it is possible to find areas that are set for capital growth, and also show a strong yield, as I outline below.

Finding areas that are set to benefit from both capital growth and rental growth

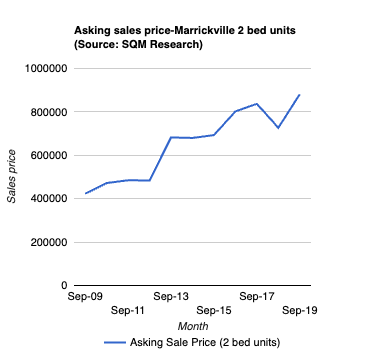

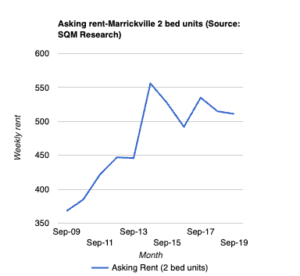

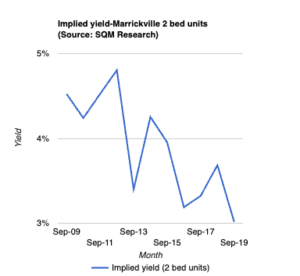

The below graph, based on data from SQM Research, shows an example of a suburb that has experienced both strong capital growth and rental growth over the same 10 year period (Marrickville, NSW). I’ve invested in multiple properties in this suburb, and I’ve watched the gentrification story unfold. In the last 10 years, asking sales prices for 2 bedroom units, common for the area, have increased by an average of 7.6% per year. At the same time, asking rents have increased by 3.3% per year. Investors who purchased in September 2009 (I invested a little earlier than this) benefited from an initial strong yield of 4.5%, and witnessed strong capital growth as well as an increase in overall rents.

The below charts provide evidence of the capital growth story, the rental growth story, and finally the overall yield position of the market.

In comparison to the situation in Ipswich, Marrickville has seen an increase in both rents and property prices. Property prices have grown by 108% over the period however rents have increased by “only” 39%, resulting in gross yields decreasing over time. An investor looking to get into the market now would need to consider whether they would be happy with yields as low as 3%. I wouldn’t be, but everyone’s different.

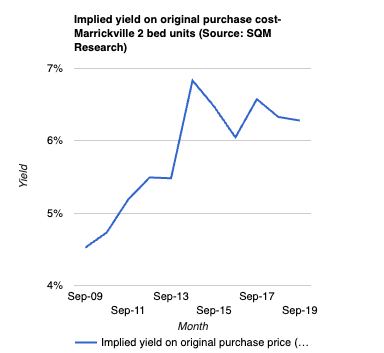

From a long-term investor’s point of view, whilst the market gross yield has decreased, their yield as a percentage of the cost of their original property has actually gone up, as shown below.

Assuming operating costs didn’t blow out, and the cost of finance was stable, these investors are likely to be in a very strong cash-flow position compared to when they started out.

The above two examples show the danger of relying on current yield as a measure to define whether an area has good investment potential or not. Yields viewed in isolation can be misleading, however when viewed as part of the larger picture they can provide an important indicator as to the current state of the local property market.

Can yield ever be too high?

Perhaps controversially, I believe it is entirely possible for yields to be too high. Yield is essentially the price someone is willing to rent your property at, relative to what they’d need to buy it for. In the case of blue chip areas, it’s common to see yields in the 2-3% range. This tells us that renters are paying a level of rent that is low compared to property values. In other words, there is an upper level that landlords can charge for their property, and this upper limit defines the top yield they’ll ever get.

In comparison, there are numerous examples of cheaper suburbs that show very high yields. A capital city example would be the region of Elizabeth, in Adelaide. Looking at units in this area, the yield has hovered around 7% for the last ten years. Looking further afield, the mining town of Moranbah in Queensland has had wild variations in yield over the last ten years, peaking at just over 10%. One way of reading these numbers is that the local rental population either can’t, or are unwilling to, purchase their own property and it makes more sense for them to continue to rent. In both cases, this doesn’t provide a great deal of comfort as to the future investment potential of areas such as these. Again, this isn’t to single out either of these areas, but just to provide some context on why it’s important to not just focus on high yield as an indicator of what makes a good investment property.

In summary

Yield is a great composite measure that helps give you a quick pulse of the local market or of a particular property. Looking at yield in isolation, however, doesn’t achieve a great deal and it can be quite misleading.

Please note: the above information and analysis does not constitute financial advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or activity should be undertaken on the basis of this information without first seeking qualified and professional advice.