I love buying property in December. Over the years I’ve completed some of my best personal and client purchases in the days leading up to Christmas. Maybe it’s because the vendors are increasingly ready to do a deal, maybe it’s because there are fewer legitimate buyers about. Regardless, I find that persevering at this time of the year is often rewarded. In fact, a couple of years ago I purchased a fantastic place in Adelaide on Christmas Eve. Admittedly, that’s leaving it a little late, but it was such a good deal it was worth working all the way up to Christmas.

Now, what will December bring this year? There’s no doubt that this year has been an interesting year for property markets around the country, and the end of the year is likely to be no different. In many cities, the market is starting to heat up. I suspect, given the momentum in the market combined with the fact that far fewer people are likely to be travelling, that we might see the 2021 real estate market spring into life a little earlier than usual. Will that mean the December deals aren’t as prevalent this year? Time will tell, but I for one will be ready for anything that pops up.

So, what’s happening in the property market?

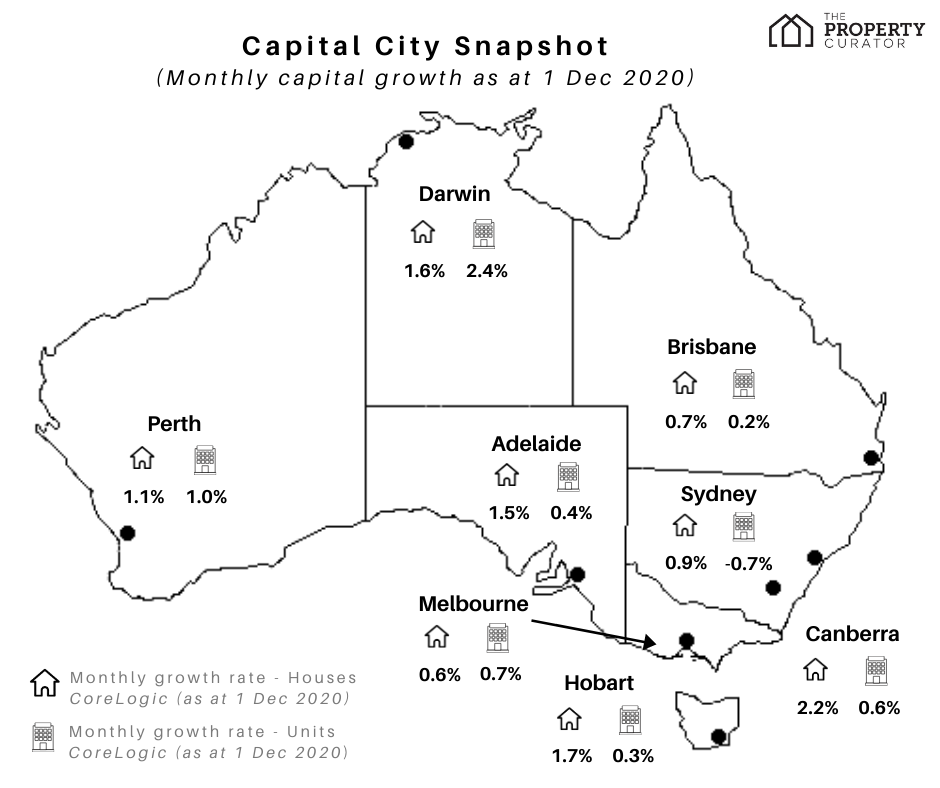

Last week, Corelogic released their monthly property price index report, and it shows that each capital city saw prices increase over the past month. The only market segment that declined was Sydney units, which are reported to be 0.7% lower than a month ago. In annual terms, every capital city has seen overall prices increase from the same time last year. Given everything that has happened this year, that’s a fairly impressive statistic. It’s no doubt partly underpinned by very cheap credit (more on that below), and the multitude of government support that has been put in place to support jobs and businesses, but it also speaks to the overall strength of the Australian housing market generally.

The below map shows the monthly capital growth across our major cities, based on the most recent CoreLogic numbers.

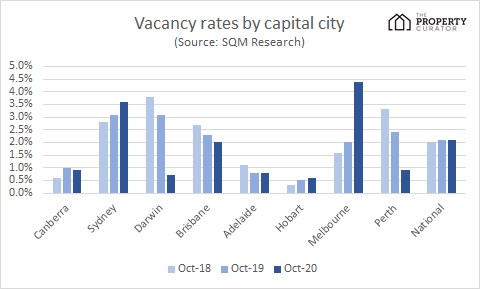

An important consideration for property investors is (obviously) the rentability of a property they own or are looking to purchase. One way of understanding how attractive a particular market/suburb is to tenants is by tracking the vacancy rates in that particular area. Vacancy rates have declined to very low levels in a number of cities (and towns) across Australia. As the below chart shows, only Sydney and Melbourne currently have elevated vacancy rates. These two cities have been particularly badly impacted by the Covid travel restrictions, affecting the student rental market in particular. This has been further exacerbated by the large number of AirBNB type properties that have been converted to long-term leases, dramatically increasing rental supply in some markets (for example Pyrmont in Sydney).

However, outside these two major cities, the story is very different. The low/very-low vacancy rates currently being seen in places such as Adelaide, Perth, Hobart and Darwin indicate a favourable rental market from a landlord’s perspective. Obviously vacancy rates are only one part of the puzzle (another one is yield), but it’s an important thing to keep an eye on, and can often be a lead indicator for rental price increases.

Whilst the above graph helps paint a picture of what it’s like on the revenue side of life for investors, another consideration is how much properties cost to hold. For most investors, the major cost is the interest on their property loan. The below graph, from the RBA, shows the gradual decrease in interest rates over time, to now be at record lows. This, combined with healthy yields and low vacancy rates in a number of our major cities, means that investors can relatively easily find cash-flow positive properties.

Now, simply following a high cash-flow strategy isn’t something I advocate for most investors, but it’s important to consider holding costs. I’ve written more about that topic here.

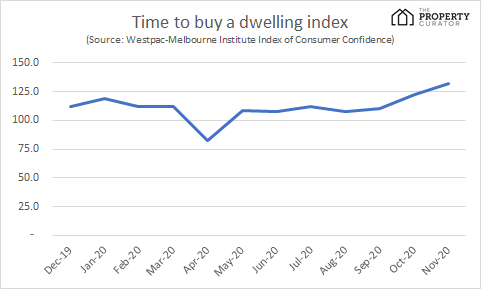

Following the gradual winding back of Covid restrictions across the country, the re-opening of some businesses, and a general optimism off the back of a number of promising Covid vaccinations, consumer sentiment has also increased. The below graph shows confidence returning to the market, particularly evident from April 2020 onwards, following the initial Covid related dip.

So, what does this all mean?

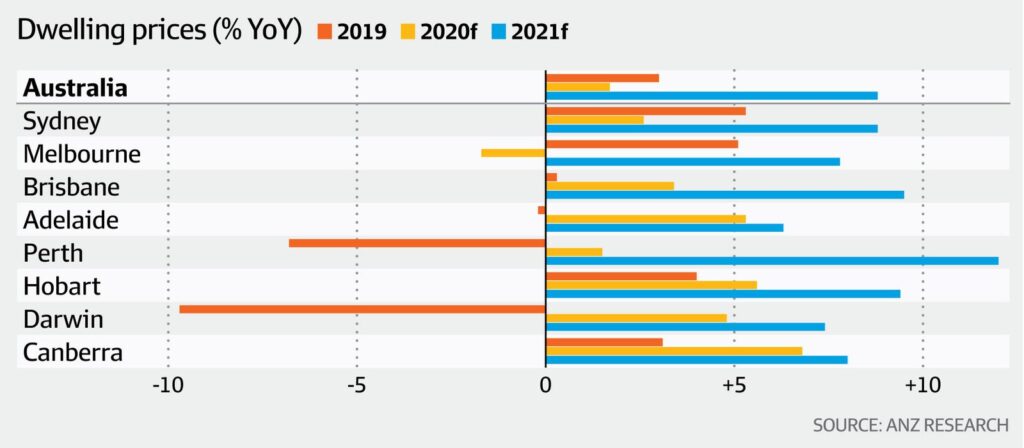

Currently, some property markets in Australia are displaying a number of encouraging signs, and are attracting the attention of property investors. Recently, ANZ released its forecast for the Australian property market moving into 2021. The current forecasts are shown below, showing expected price growth across all capital cities, lead by Perth and Brisbane with expected capital price growth of 12% and 9.5% respectively. Of course, these are just forecast numbers, and the usual caveats apply about relying on a single forecast. However, they are substantially more bullish than those published by the ANZ earlier in the year, and reflect a cautious optimism within the industry.

Putting all these things together, it’s clear that there is a sense of anticipation within the Australian property market. Auction clearance rates are relatively strong, interest rates are at historic lows, there’s increased interest amongst many buyer’s, and the Covid situation (at least within Australia) looks a lot more promising than earlier in the year. Combined with a lack of quality stock in certain areas, and property is again becoming a much talked about (virtual) BBQ topic. Now, this doesn’t mean you should just rush out and buy any property, but it does mean there are definitely great buying opportunities around, if you know where to look.

If you’d like to discuss your options for purchasing a property, now or next year, feel free to reach out to schedule a complimentary call via this link.

Please note: the above information and analysis does not constitute financial advice in any way, and it should not be relied upon. It’s important that you seek guidance from licensed professionals, who can provide advice based on your individual needs. No investment decision or activity should be undertaken on the basis of this information without first seeking qualified and professional advice.